As the cost of higher education continues to rise, it’s common to see grandparents stepping in to support their grandchildren’s college expenses. It can be a wonderful gift for a grandparent who wants to see a grandchild benefit from a college education. For both the parents & grandparents though, there are tax and financial aid considerations that should be noted. Let’s delve into the tax tips for grandparents paying for college. You need to understand the financial aid ramifications first.

Financial Aid Definitions

There is one common form that must be completed by anyone applying for financial aid. That is the Federal Application for Federal Student Aid (FAFSA). There is much to discuss about the FAFSA, but for the purposes of this article, you must understand that the FAFSA takes into account four financial factors:

- Parent Income

- Student Income

- Parent Assets

- Student Assets

It does NOT take into account any other assets of other family members. For example, if a grandparent owns a 529 plan with the child titled as the beneficiary, it does not need to be listed on the FAFSA as an asset. However, if you pay for schooling from a grandparent-owned 529 plan, it would count as income to the student, which is assessed as a far higher level than an asset would be. Translation: You can hurt your chances of receiving need-based financial aid if the grandparent pays for schooling from his/her 529 plan.

There have been some changes which will rectify this for the FAFSA, but we first want to talk through another form that must be completed and taken into account, the CSS Profile.

CSS Profile

The other form that may need to be completed is the CSS Profile. This form is needed for a select group of schools. Of note, these schools use the institutional methodology. These schools also include the same 4 categories of assessment listed above, but there are differences & additional nuances to be aware of. For example, the CSS Profile will ask and assess home equity in a primary residence, which the FAFSA will not.

Distinguishing between these two is vital to understanding how grandparents can best save and pay for college to maximize financial aid.

The FAFSA Simplification Act

On December 27th of 2020, the FAFSA Simplification Act was passed. While there are a significant number of changes that have taken place, a big one of note is the usage of Grandparent-owned 529 plans. In particular, grandparents would have previously needed to wait until the child’s junior year in college to start dispersing 529 funds to not have a negative impact on financial aid. With the passage of this act, that changes. Grandparents can now freely gift to the grandchildren without the worry of losing need-based aid at federal methodology schools.

But there is a catch. For schools still using the CSS Profile, the previous rules still apply. So it becomes very important to understand which type of school your child is attending when considering this rule.

Taxability Considerations

Now that you have a general idea of the financial aid impact grandparent-owned 529 plans have, let’s look at the taxable considerations.

State Tax Deduction/Credit (Maybe)

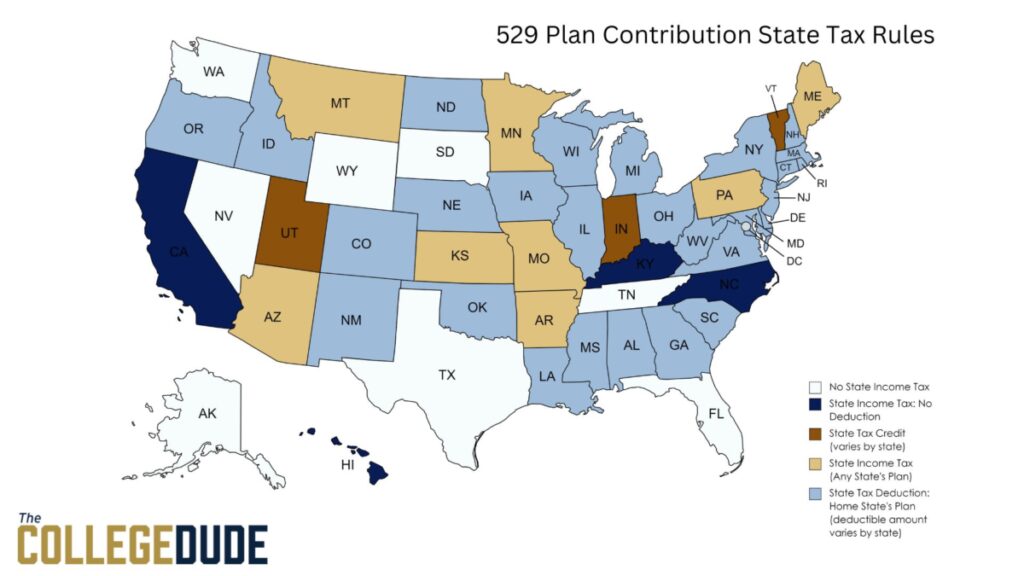

Depending on your state of residence, you may see a state tax deduction or credit. The credits & deductions are a bit detailed, but for the 50 states, here’s a high level breakdown:

Depending on your state of residence and the plan you are contributing to, you could get a state tax deduction. You should plan with your advisor and accountant if this is something that you have questions on.

Federal Tax Considerations

When it comes to federal taxes, there are some great benefits to owning a 529 plan. When it comes to the growth and distributions, that is tax-free assuming the funds are used for qualifying education expenses. This is no different whether this is grandparent-owned or parent-owned.

But the real magic and one of the best tax tips for grandparents paying for college can come into play when avoiding estate tax.

Let’s understand something first – the current federal estate tax in 2023 is for an estate worth more than $12.92 million (double for married couples). This only applies to a few families. But this amount is set to sunset in 2025 (unless Congressional action is taken). It will be in the neighborhood of roughly $6 million assuming no action is taken. We must also remember it depends on the political climate at the time. Here is a link to the history prior to 2014.

So why can a 529 plan make sense? The contribution is removed from a federally taxable estate. It can either reduce your estate tax, or even avoid it altogether.

Gift Tax Considerations

The 529 plans do offer a great loophole though. You can frontload 5 years at one time and superfund the plan. You can see more details here. But if a grandparent wants to make a sizable gift – this option is available.

The planning you are able to do with these flexible plans can provide much value and tax savings for both the grandparent & child alike.

Direct Payments to Colleges

The last thing that grandparents should consider are the gifting considerations. If you’re looking for simple when it comes to taxes – this is it. The IRS allows for an unlimited amount that grandparents can give when it comes to college tuition. There’s a special gift tax exclusion that’s provided to cover this. However, it doesn’t cover books, supplies, or room & board. That can be covered (potentially – depending on the cost) with the gift tax exclusion dollars.

But this is not a foolproof strategy. Much like we discussed above – the student could see this come in as untaxed income. That can drastically affect aid and can greatly disrupt a strategy.

Paying off Their Loans

Another strategy that could be utilized is paying off a student loan that the child may incur. For students, this wouldn’t affect the financial aid eligibility, and could give the student the kick they need to stat motivated. It could also allow the student to claim the student loan interest deduction if he/she fits the other necessary criteria.

But there could be problems with this – as the payments would count as a gift. There is also the concern the student may have, in that a change of circumstance could disrupt this plan, as there is no guarantee.

What Should You Do?

529 plans offer great tax benefits for grandparents, parents, and students alike. In my opinion, they’re one of the most advantageous tax vehicles to use, and Congress has clearly made them even more flexible in recent years. You should be speaking a financial planner or accountant to get a better understanding. There are also ways to help pay for schooling, but financial aid considerations must be accounted for. While there are many tax tips for grandparents paying for college, the ones mentioned can be utilized inside a plan with relative ease. Determining if this can make sense in your plan is a great strategy to consider!