When considering the best college savings plan, it’s important to understand the pros and cons of a 529 account. If you’ve read any of my prior posts, you’ll know I’m a big proponent of 529 plans. You can see more of the advantages and updates discussed in this post. But while 529 plans offer valuable tax advantages, they may also come with certain limitations and drawbacks. This article outlines the 4 downsides to 529 accounts so that you can make an informed decision about your college savings strategy.

Limited Investment Options

529 plans are administered on a state level. Therefore, not all 529 plans are created equally. Some 529 plans are well-known for their low cost and wide array of investment choices, such as the Utah plan. But there are other plans that are known for high-cost and limited investment options. States like Rhode Island only offer target-date funds, which can be a viable option, but a total of 8 other investment options if you’d rather pick your own funds. While the funds themselves are not necessarily a bad option, investors seeking more investment choice may need to look elsewhere.

Depending on your state’s tax law, it may make sense to invest in your home state’s 529 plan. But in the event that the investment options are too costly or don’t have the investment choice you desire, it may be worth considering another state’s 529 plan.

Differing Rules from State to State

While 529 plans in general are easy to establish, they can be confusing to fully understand. For example, each state has their own tax law, in addition to federal tax law. Therefore, some states may offer a state income tax deduction if you contribute to a 529 plan. Other states may require you contribute to the home state’s 529 plan in order to receive that tax deduction. For example, PA allows taxpayers to qualify for the state income tax deduction for contributions made to any state’s plan. NJ residents are only eligible to deduct state income tax if contributions are made to the NJBEST 529 plan.

Furthermore, each state has differing rules for how much you can deduct from your state taxes. As if that’s not already confusing enough, some states will apply additional penalties on 529 plan withdrawals not used for qualifying educational expenses.

Penalties

There are some penalties associated with 529 plan withdrawals that are not used for qualifying educational expenses. The interest in excess of your contributions to the 529 plan are taxable, and there’s an additional 10% penalty tacked onto that.

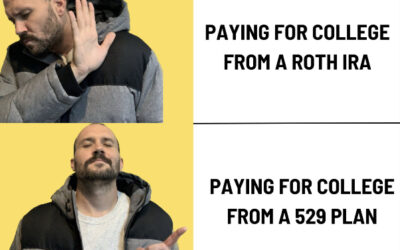

Thankfully, Congress has made 529 plans very flexible in recent years to make this one of the lesser impactful downsides of the 529 accounts. In particular, they’ve allowed up to $10,000 from a 529 plan that can be used to pay off an existing student loan. They also allow the ability to transfer unused funds to another family member’s 529 plan. Lastly, and perhaps most advantageous, they recently allowed the ability to “roll over” unused funds in a 529 plan to a Roth IRA. It’s a great way to get a new graduate started on a retirement plan.

Federal Aid Reporting

When applying for financial aid, there are a few steps you must follow. One is completing the FAFSA. While doing so, you’ll need to list 529 plans that you own for you and your children. These accounts will be considered by the Department of Education and institutions, and could drive up your Expected Family Contribution (EFC).

Again, this is one of the downsides of the 529 accounts that can be addressed. By proper planning, it shouldn’t deter someone from saving in a 529 plan. The amount in which 529 dollars raises the EFC is 5.64%. So, for every $1,000 saved in a 529 plan, $56.40 will be decreased in any need-based aid. That doesn’t mean you are not available for scholarships based on the student’s merit. Only that need-based aid will likely be affected.

Conclusion

529 plans can be an excellent tool to save for college. They have numerous benefits and recent legislation changes have only added to it. But much like any financial instrument, they are not perfect. They are also not a one-size-fits-all product. The 4 downsides to 529 accounts should be considered and planned for. The application of these accounts are what are most important, and a plan for college must be established to best utilize these accounts.