For many families out there, they may not yet be familiar with how TheCollegeDude has helped families pay for college. I wanted to provide an example of what that looks like, and how this could apply to your situation. I created a college planning case study for that reason. This is 100% hypothetical, and the “recommendations” are considerations for this family. Ultimately, my goal and strategy in working with families is to save as much money as possible, while achieving their goals. Let’s unpack:

The Facts – The Johnson Family

For our college planning case study, we’ll make up a hypothetical family. Bill & Melinda Johnson have been married for 19 years while living in central PA with 3 awesome and moody boys:

- Calvin – a rising senior in HS making his choice between Penn State (main), Lycoming College, and Lehigh University. Calvin has a 3.8 GPA, 3.92 weighted GPA, and got a 1450 on his SAT’s. He’s ranked #20 in a class of 310. He’s considering grad school after undergrad classes, but not 100% sure. He’s also not currently working.

- Chad – Chad is a rising 9th grader. He’s interested in college, but unsure at this time.

- Earvin – Earvin is a child prodigy on the basketball court. They call him “Magic” but he’s only in 7th grade, so college is a bit too far ahead.

The Goals

- Bill & Melinda have both worked hard to get to where they are. Bill is a software engineer and makes $150k per year. Melinda is on the support staff at her local school making $35k per year in a full time position. Both enjoy their jobs, but want to be in a position to retire by the time they both reach 65 (Bill age 50, Melinda 45).

- They want to help the 3 boys pay for school, but recognize they may not be able to fully fund their education. They want the boys to have “skin in the game,” while also avoiding crippling debt for themselves and the boys.

- They want to make sure they’re currently taking advantage of every tax break available at both the state and federal level.

- They want to make sure their current plan doesn’t have any major gaps.

- They want to be debt-free in retirement.

The Financial Facts

The Johnson’s are able to save 20% of their net income, with roughly 50% of their budget going toward their fixed expenses, and 30% going toward their discretionary expenses. For the sake of this college planning case study, we’re only including the most pertinent information – specifically geared toward plans helping the Johnson’s navigate college.

Savings Breakdown

- Bill contributing 10% to his retirement (5% match)

- Bill is currently maxing out his Roth IRA contributions ($7500/year this year)

- Melinda is saving 7.5% of her pay in her pension, with no additional contributions.

- They’ve been saving $150/m into each of the 3 boys’ 529 plans.

- They’re currently paying $150 extra on their mortgage every month toward principal.

- Bill & Melinda have saved $40k in their emergency fund, which is equivalent to about 5 months of expenses. They’re currently getting 1% on the savings account.

- Bill & Melinda also have $20k in a separate fund for the 3 boys’ college expenses. it’s a savings account, also earning 1%, but is not considered part of the emergency fund.

Insurance & Estate Planning

- Bill & Melinda have not completed an insurance audit or analysis on life, disability, or auto & home insurance in the last 5 years.

- Bill & Melinda do not have legal documents in place, nor have they checked beneficiaries recently on their 401(k), pension plan, or Roth IRA.

- Bill has an HSA through work, but is on Melinda’s plan at the school, which is not a High Deductible Plan but offers great benefits.

Retirement Planning

- As mentioned above, Bill is saving 10% of his pay into his pre-tax 401(k) (with a 5% match), and Melinda is saving 7.5% into her state pension.

- Both would like to retire within 15 years, and in Bill’s 401(k) the balance is $250k. Melinda’s pension should match her net pay at age 65.

Investment Planning

- For the sake of time, we’ll discuss how the 529 plans are invested. All 3 are in target date funds based on the boys’ start of college enrollment. The current yield on Calvin’s account is 1.5%.

Tax Planning

- The Johnson’s haven’t done much tax planning to this point. Their MAGI is $168k.

- Bill has prepared his own tax return to this point.

College Plan

Unfortunately, even though this is a college planning case study, we see this approach throughout. The Johnson’s have not been sure what to do with the college planning to this point. They plan to complete the FAFSA and project what the net costs are, but are unsure. As a result, they feel pretty clueless when it comes to planning for college. For this college planning case study, we’ll focus primarily on the actions they can take for both college funding and overall financial planning success. Their goals are going to be kept in mind while doing so.

The Proposed Solutions

To be clear, this is not an all-encompassing list of recommendations for the Johnson’s, but rather the tactics they should be looking to consider. Many of the recommendations apply to college planning, but all will have an impact on the financial plan, and you’ll see why that is.

Action Step 1: Calculate the Student Aid Index

By calculating the Student Aid Index (SAI), the Johnson’s will have an idea of the starting point of how much they’ll be expected to pay for college. It’s not an exact number, but it’s a start.

After doing so, they found 2 different SAI’s – one is for federal methodology schools (Penn State & Lycoming), while the other is for an institutional methodology school (Lehigh).

For the Federal Methodology, the SAI is $48,000 (per year) and the Institutional is $29,000 (per year).

Action Step 2: Complete the Net Price Calculators of Each Prospective School

Each school has a net price calculator on their website. They also offer competitive scholarships, which could make the net price calculation appear a bit fuzzy. As a result, it’s good to plan for a targeted range based on research. After the research, here’s what we found:

PSU: Projected net cost range: $32k-$36k/year

Lehigh: Projected net cost range: $20k-$30k/year

Lycoming: $27k-$35k/year

Action Step 3: Formulate the Budget

At this point in time, we must first wait for the acceptance and subsequent financial aid packages to truly know what our offers are. But there’s nothing stopping us from gathering the info to formulate a budget in the meantime. The sources are made up as follows:

- Federal Direct Student Loans: These loans are very favorable, and typically recommended if any loans are to be taken out.

- Scholarships & Grants: We will get some from the schools directly, but outside scholarships should also be sought after.

- Tax Credits: The American Opportunity Tax Credit is within range, but some planning must be done to get the full benefit.

- 529 funds: Thankfully, the Johnson’s have saved $15k (to this point) for Calvin’s education within the 529 plan.

- Other savings: This can include the amount in savings the Johnson’s have earmarked (we divide by 3 so it’s equitable among the 3 boys per the wishes of the Johnson’s).

- Other sources of cash flow: This could include potential for grandparent plans. In this case, there is no grandparent help.

- Their own cash flow: This may or may not be able to be found for the Johnson’s, but we will analyze.

- Other loans: We want to be very strategic about this.

Action Step 4: Strategies to Increase Savings

There are ways we can strategically act to qualify for more tax credits, save on state taxes, and still keep goals in tact. Some of the strategies are as follows:

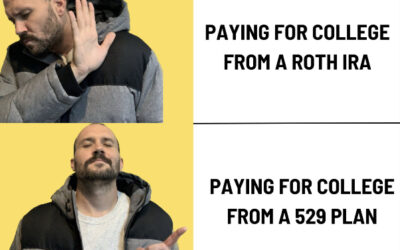

Divert Roth savings to Bill’s 401(k)

Don’t get me wrong, I’m a huge proponent of the Roth IRA. I think it offers an incredible long term savings. But by diverting those funds to a pre-tax 401(k), it allows us to get closer to the maximum savings toward the American Opportunity Tax Credit.

Divert extra mortgage repayment to 401(k) savings

By doing so, we are again looking to qualify for the maximum AOTC number. The 401(k) savings, can be allocated safely within the 401(k), and those funds will ideally grow at a similar rate to which the mortgage interest is accruing. By doing this, we have the option to take a 401(k) distribution to pay off the remaining amount that would’ve been paid off over time instead. However, we are now within better range to be receiving the maximum AOTC.

Divert the earmarked non-qualified savings into the 529 plan

based on the budget each year for the children. Assuming Calvin will be using some of the earmarked savings account for college, we’ll look at moving some of those dollars to the 529 plan. The reason? State tax savings and federal-tax free growth. In PA, the Johnson’s get a 3.07% state tax deduction for 529 plan contributions, so for every $1,000 contributed, they save $30.07 in state tax. Since the funds are earmarked for college (and we know Calvin will use it), we plan to utilize that as a potential option.

Reallocate the 529 plans

This is an important one. The target date funds are not the worst option, but they’re not the best either. For Calvin, we’ll move to a high-yield money market fund within the 529 plan. If one doesn’t exist in his current account, we can look to do a 529 plan rollover. For the other 2 boys, we’ll want to make sure we’re allocating based on their time horizons. These changes can save us from an expected market drop as the boys are approaching college age.

Allocate Current Savings to a High-Yield Savings Account

Thankfully, the Johnson’s have a well-funded emergency fund. However, they should be focusing on maximizing interest. A difference of 3% APY in their plan can make up a difference of roughly $1200 per year. This can be done without much effort and no added risk.

Additional Steps can and should be taken

To be clear, this is not an exhaustive list. But it’s a great place to get started for the Johnson’s. These moves don’t require them to cut back on current lifestyle, but rather can enhance their current plan.

Action Step 5: Analyzing Loan Options

No college planning case study is complete without analyzing student loans. Thankfully, we have a couple of good options at our disposal. To start, Calvin should look for the Direct Loans in his name only to get him closer to the net cost. But they’re often not enough to bridge the full gap. This case study is no exception.

Private Loans and Parent PLUS loans make up (high level) the other options. Let’s start with potential private loans.

Private Loan Options

Generally speaking, with good borrowing credentials, private loans can be a good option. Assuming Bill or Melinda have good credentials to be a co-signer, we’d look at private loans as an option for Calvin. But that could interfere with the Johnson’s goal of being debt-free in retirement is Calvin defaults. However, if we are to look at a private loan option, it would be state agencies we’d want to venture into first to see if there’s debt that’s forgivable and or manageable for Calvin.

Parent PLUS Loans

These loans can be an option – and the pro’s and con’s will be weighed as follows:

Pro: If taken out in Melinda’s name only, these loans could eventually be on an Income-Contingent Repayment plan, and with her public sector job, eventually qualify for Public Service Loan Forgiveness.

If we assume Melinda takes out $60k (total balance) of a consolidated federal loan (previously a PLUS loan), and she continues to work full time in the public sector, she could be on a payment that would be under $100/m, and have over $100,000 in PLUS loan debt forgiven! Tax free! The caveat? She and Bill must be married filing separately for 10 years to achieve that. That means not qualifying for the AOTC, no more Roth contributions, and less favorable marginal tax brackets.

A true tradeoff would need to be planned out to see if this is worth it, along with the assumption that Melinda would work until A65.

The Next Steps

To reiterate, this college planning case study includes highlights only. There would be a number of other recommendations made. However, this provides a sample of planning items families should be considering. The recommendations provided are not to be taken as advice, but rather a hypothetical. When establishing your college plan, be sure to include elements that contribute positively to your financial plan.