Trade school is an excellent way for students to gain specialized skills, which can lead to a secure career in the long term. But students often face a difficult decision: financing their trade school education by taking on considerable student loans. This post will discuss the pros and cons of taking out student loans to pay for trade school, as well as advice on loaning money responsibly.

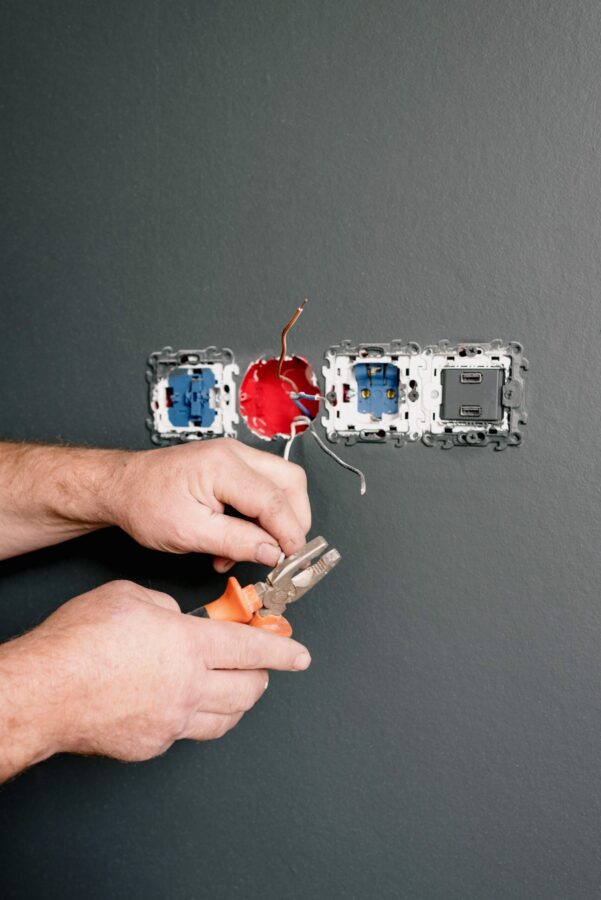

Why Select a Trade School?

Trade schools (otherwise known as vocational, technical, or career schools) have been gaining in popularity in recent years. As the cost of private, liberal arts schools continues to rise, it’s no guarantee graduates land the job of their dreams. Trade schools offer a shorter time frame, but far more specialized curriculum, which can provide employment more readily.

Currently, there’s a blue ocean for many trades. By choosing a trade and having a specialized focus, a graduate should have no shortage of options available. That said, not every school is a great fit – be it financially or otherwise. It’s important to do your research and determine that the trade and the school you choose is the proper fit.

Get Started

When researching trade schools, it’s important to verify that the institution is accredited by a recognized educational accrediting agency. This ensures that the school’s curriculum meets the standards of quality and excellence in education. Additionally, it means that credits earned at an accredited school may be transferable and accepted by other institutions. Prospective students should also check to see if their state has approved the trade school and whether or not it offers financial aid programs for eligible students. To determine if your school is accredited, it’s worth checking out this tool.

Assuming the school is accredited, you’ll find that trade schools use the Free Application for Federal Student Aid (FAFSA) to apply for federal financial aid, such as grants and loans. The FAFSA form helps determine a student’s eligibility for these programs. It also serves as a way to track and document the application process. Trade school students who complete the FAFSA are able to demonstrate financial need to their chosen institution and can be considered for additional types of aid such as scholarships, grants, or work-study programs.

Applying to Schools

Applying to a trade school is quite different from applying to a four year college. Trade schools typically require less information and fewer documents, such as transcripts and test scores, making it easier to apply. Additionally, trade schools often do not require an essay or personal statement like four-year colleges do. Trade schools also tend to process applications more quickly than traditional colleges and will typically provide an admission decision within several weeks of submitting an application.

That said, the financial aid process is similar – and many of the ways to pay for a traditional 4 year college can also be applied to paying for trade school. There are many sources you can use, including 529 plans, which cover expenses to accredited schools.

Paying for your Program

What’s of vital importance – know how to pay for your program before you go! Budgeting your 2 year cost can only be done when you consider what you have saved, can cash flow, and can receive in aid. Additionally, there could be tax credits available. These options should be exhausted first before loans are considered.

While it takes work, a plan can be created to pay for schooling. A great place to start is checking out this pre-recorded webinar.

Conclusion

Trade school has been overshadowed by the four year degree in recent years. But it doesn’t change the fact that it’s a viable option for a large segment of the population. More importantly, our economy and our society need educated and competent tradesmen. Much like we must do our best to avoid student loan debt for college attendees, trade school attendees face the same dilemma. Book a call with me if you want to learn more.