Parent PLUS loans can create a lot of tension between the parent and the student who’s going to college. Most parents may not be aware that the loan is in your name as the parent. And at best, it’ll be a handshake agreement between you and your child to make sure that your child’s able to repay. Understanding how to PLUS loans work can keep you on track for retirement. They will also allow for the student to get off to the desired start every parent wants to see. Here are the 5 things parents must know about Parent PLUS loans.

Terminology

The first thing that you want to be aware of are the terms. So how do you actually qualify in terms of qualification? There are really three high level things that you must be aware of.

Who Qualifies?

The first is that you actually need to be the adoptive or the biological parent of the child who’s planning to go to school. The second is that you cannot have an adverse credit history. I previously made a video which is going to go into more detail about what an adverse credit history actually means as far as the Department of Education is concerned.

And the third thing is that you need to be deemed eligible for other purposes when it comes to actually applying for financial aid. So, for example, you need to complete the FAFSA, the Free Application for Federal Student Aid, if you want to take out a Parent PLUS loan.

Who is Obligated to Repay?

Parent PLUS loans are solely in the parent’s name, so the child has no legal right to repay this actual loan. While a handshake agreement can be agreed upon, the borrower has the obligation to pay. In this case, the borrower is the parent.

While Parent PLUS loans are solely in the parent’s name, there are ways in which you could transfer them to the child.

However, you really want to be making sure that if you’re going to do that, you know the benefits of what you’re giving up. Having the Parent PLUS loans, which are issued directly by the Department of Education, offer some notable benefits. So, you need to be aware, if you’re going to be transferring the loan to a child’s name, the only way that you can do that is through a private refinance and you will be missing out on some potential great benefits of keeping the loan direct with the Department of Education.

How Much Can I take Out?

One of the other things that you need to be aware of when it comes to taking out Parent PLUS loans is the loan limit. Where many parents have gotten into trouble is the fact there is no loan limit before the cost of attendance is reached. In other words, you can cover the full gap between financial need and cost of attendance. That is how many parents have found themselves with significant, and in some cases, insurmountable balances.

So, for example, if you’re going to a school which is $60k per year, and the student receives $20k in aid, that leaves a $40k gap. Some parents have covered that gap with a Parent PLUS loan, and the school allows this.

The problem is if you do this over four years for multiple children, it can really add up. You need to be crystal clear in understanding how much you’re planning to take out for your child and understand what the repayments are going to look like.

Interest Rates & Origination Fees

Two additional items of importance are both the interest rate and any fees that are involved inside of a Parent PLUS loan.

For the 2023-24 school year, Parent PLUS loans are just under 8.05%. You can defer payment on these loans, but the interest accrual will start right away upon disbursement.

Parent PLUS loans also have an origination fee, meaning the loan balance has an added fee upon disbursement. That fee is 4.228%, so for every $10k borrowed, $422.80 is added to principal right away. These loans will accrue interest and have the origination fee added, so you should be aware of how quickly these balances can grow.

Repayment

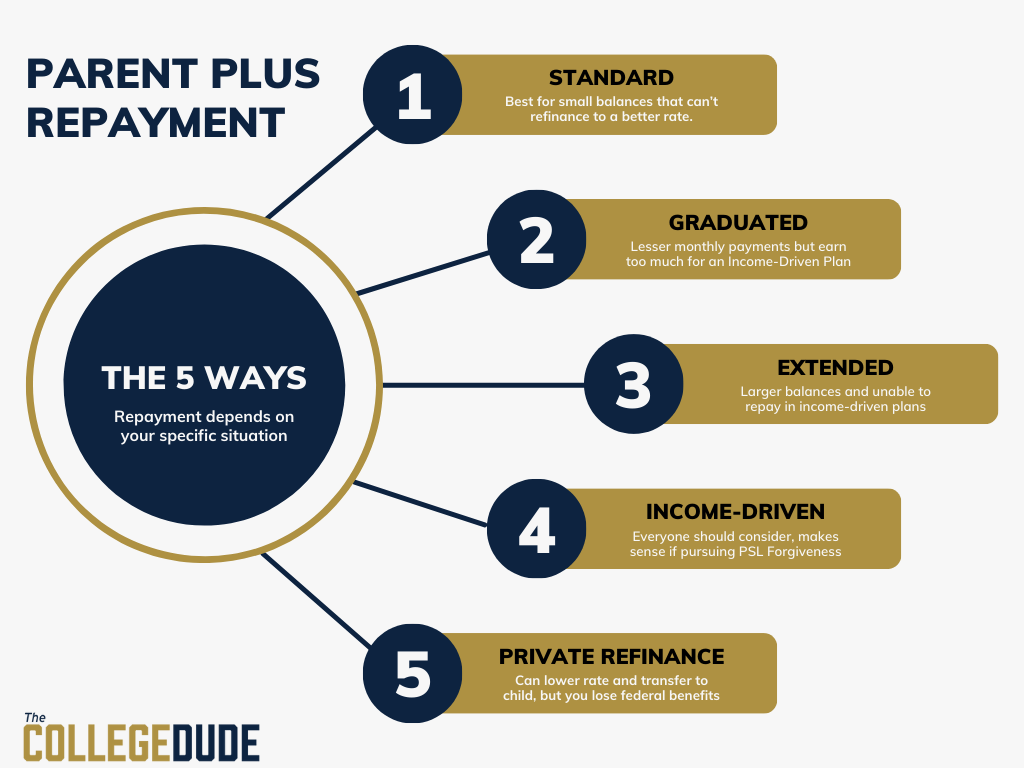

The second thing every parent must know is the repayment structure of Parent PLUS loans. Of the 5 things parents must know about Parent PLUS loans, repayment is the most impactful. The default type is the standard repayment. The standard repayment takes the total balance and then amortizes that amount over a 10 year time period. As a result, that’s usually the highest monthly payment that a Parent PLUS loan can be repaid upon.

The second type is the graduated repayment. The graduated repayment usually starts out a little bit lower, but eventually will go higher in terms of the monthly repayment. Every two years, that graduated repayment goes up. So it could be good for parents who may be in a position where they don’t have the funds now, they need a lower monthly payment, but in the future feel that they can cover an additional increase.

While it will lead to higher interest repayments over the life of the loan, there is also the extended option. This option gives parents more flexibility in repayment. You must have at least $30k of a balance to utilize this option. Thankfully, these 3 options are not the sole options available. But to allow for additional repayment plans, you must go through loan consolidation.

Consolidation of Parent PLUS Loans

Currently, there are two high-level options that are (potentially) out there when it comes to consolidation and repayment. The first is known as the double consolidation strategy.

At a high level, the double consolidation strategy could open the door to any income-driven repayment plan. However, this is a very nuanced plan, requiring a level of detail to do things correctly. The Department of Education has issued guidance in August if this year that reflects changes, however. This plan is going away no later than July of 2025. Some attorneys have also stated this strategy may already have been closed. Regardless, there is still a beneficial offer on the table.

The other option available is the income contingent repayment (ICR) plan. The ICR plan is one of the oldest and least advantageous of the different types of income driven repayment plans. And it’s also the least advantageous. However, it can make sense for the right types of parents when it comes to repaying this, and oftentimes it can be better than the actual standard or graduated repayments.

So you want to give some consideration into what these payments could look like when you’re out of school. Thankfully, there are a number of calculators online that you can actually calculate this information ahead of time. That way you’re not left wondering what a monthly repayment can be when repaying after four years of your child’s undergrad education.

Forgiveness & Discharge Options

The fourth thing to cover are the forgiveness options. While we will cover Public Service Loan Forgiveness (PSLF), there are a couple of discharge options available. Of the 5 things parents must know about Parent PLUS loans, forgiveness requires planning ahead.

Discharge

Unfortunately, is a loan is discharged, it’s usually a result of a tragic event. In the case the parent or child of the parent who took the loans passes away, the Parent PLUS loan balance can be discharged. Another way in which loans can be discharged is if there’s permanent and total disability as defined by the Department of Education.

So if you have one of these things happen to you, understand that the parent plus loan debt can be discharged under those circumstances. There are some other nuanced ways in which these can be discharged. Check out the education department’s website to determine if any of those things could be applicable to you.

Public Service Loan Forgiveness

Many parents may not be aware, but Parent PLUS Loans can be forgiven through Public Service Loan Forgiveness (PSLF). Public Service Loan Forgiveness can allow for is a 10 year forgiveness schedule. So long as you make 120 qualifying payments, you can have federal student loan debt forgiven. While it does include certain types of federal loans, it doesn’t include a standard Parent PLUS loan. It needs to be consolidated and then repaid on one of the income driven repayment plans.

Both the Income-Contingent strategy & Double Consolidation strategies do qualify as Income-Driven Repayment Plans. By enrolling in these plans, you can set forward a path toward PSLF.

Standard Forgiveness Programs

The standard forgiveness within some of these repayment plans. Such as the Income Contingent Repayment Plan, you’re at 25 years in which the amount that you still owe would be forgiven.

Some of the other repayment plans could have it as early as 20 years. But you want to make sure that you have, again, plotted out how long it will be that you need to be making repayments. And, importantly, you want to make sure that you understand if any forgiveness options are available to you.

Common Mistakes

The fifth thing that we’re going to talk about are the common mistakes that parents end up making.

The biggest mistake many parents commit is simply not knowing the way these loans work. From terminology to repayment strategies to discharge and forgiveness options, knowledge is key. Parents and students alike must make sure they’re fully aware of the options available.

The repayment strategy may be the most important one, as it so commonly ties into retirement planning. By knowing what the repayment amount (and how long) will be beforehand, the Parent PLUS loans can make for a winning loan strategy.

Varying the Parent Name

One of the other problems that I see is sometimes parents will vary the spouse who ends up taking out the repayment plan. In theory, this could work under certain circumstances. But this becomes problematic if you have a parent who qualifies for PSLF.

The PSLF is based on the borrower’s qualifying criteria, not spousal criteria. So if one spouse works in the public sector and the other in the private sector, PSLF is available to the public-sector spouse. Conversely, repayments are based on income, and depending on the IDR plan and filing status, individual spouse income. Lowering the payment can be utilized by having the lower-earning spouse borrow the loans.

Doing Nothing

The last mistake parents make is that they stay on the standard repayment without considering alternatives. Income-driven repayments plans should at least be considered by all parents. It may also be worth considering a private refinance to the child’s name. But these plans must be tailored to individual financial plans.

What you should do

Parent PLUS loans have created tension between parents and children. It doesn’t have to be this way. Parents should focus on staying on track for retirement, while students should get off to a good start. If both parents and students are informed going into college, disaster can be averted.

If you follow these 5 things parents must know about Parent PLUS loans, you’ll be off to a good start.

For a better way to plan and pay for college, get in touch with me and learn your options.