If you’re looking to pay for college, there are no shortage of possibilities. You are probably familiar with the most popular account, the 529 plan. The 529 plan has been around since 1996. These are typically going to be issued by the state of your residence. However, you can own a 529 issued by any state. In recent years, the Roth IRA has become a popular tool to saving and paying for college. So which of the 2 is superior? A 529 beats a Roth IRA when saving for college. Let’s unpack.

Roth IRA Basics

A Roth IRA is renowned for its tax benefits, primarily designed for retirement savings. However, it also offers advantages for higher education expenses. Unlike traditional IRAs or 401(k)s, Roth IRA contributions are not tax-deductible, but they grow tax-deferred. The key difference is that Roth IRA funds can be withdrawn federal penalty-free for qualifying expenses. They can be withdrawn tax and penalty-free usually after five years and reaching age 59.5.

There are contribution limits, with a maximum of $6,500 (or $7,500 for those over 50) for 2023. The contribution limits are based on earned income, and you must have earned income to contribute. Roth IRAs offer a wide range of investment options, making them a powerful tool for retirement planning. However, using them for education expenses can affect long-term growth.

529 Plan Basics

When comparing 529 plans to Roth IRAs for education savings, several distinctions become evident. While I believe a 529 beats a Roth IRA when saving for college, there’s more to it. Understanding 529 plans and the differences between them and Roth IRAs can influence your choice of the most suitable savings vehicle for your needs:

Investment Options

Unlike Roth IRAs, 529 plans typically offer more limited investment opportunities and allocations. In a Roth IRA, investors can access a wide range of investment choices. However, 529 plans usually provide a selection of funds or models based on your state’s plan. These options can vary from conservative to highly aggressive allocations. Additionally, some 529 plans offer target-based funds that adjust based on your child’s age. These funds gradually become more conservative as college enrollment approaches.

Tax-Free Growth:

One significant advantage of 529 plans is the ability to enjoy tax-free growth when funds are used for qualified education expenses. The IRS defines these expenses in detail in IRS Publication 970. These include items such as tuition, room and board, books, and equipment. As long as the expenses align with the IRS criteria, a 529 plan can be an efficient funding tool.

State Income Tax Deductions:

Depending on your state of residence and its tax regulations, contributing to a 529 plan may offer a state income tax deduction. However, it’s important to note that some states restrict this deduction to contributions made to their specific state plan. To maximize your potential tax benefits, it’s crucial to understand the rules and regulations of both your state’s plan and your state of residence.

Penalties and Flexibility:

529 plans offer the advantage of flexibility in terms of income and contribution limits. Generally, there are no income limits, and contribution limits are typically high, though they can vary based on your state of residence. However, it’s vital to be aware that taking a non-qualified distribution from a 529 plan. One that doesn’t meet the criteria for a qualifying education expense can result in a 10 percent penalty and potentially taxable interest on the distribution. To avoid penalties, ensure that your distribution covers a qualifying education expense.

In summary, 529 plans offer unique benefits for education savings, including tax-free growth, potential state income tax deductions, and flexibility. However, it’s essential to understand the specific rules and regulations of your state’s plan and your state of residence. Careful planning and consideration of your goals can help you make the most of this powerful college savings tool.

529 v Roth When Funding College

To determine why a 529 beats a Roth IRA when saving for college, we must compare the two. Let’s dive into a detailed analysis of the advantages and disadvantages of using Roth IRAs versus 529 plans. Specifically, we want to look into it for funding your college education.

Roth IRA Benefits:

- Flexible Withdrawals: One universal rule with Roth IRAs is that you can withdraw your contributions at any time without incurring income taxes or penalties. This is because Roth IRAs are funded with after-tax dollars, allowing you to access your contributions tax-free and penalty-free.

- Penalty Waiver for Education: An often-overlooked advantage of Roth IRAs is that you can waive the standard 10 percent early withdrawal penalty if the funds are used for qualified education expenses. This means you won’t face penalties on earnings beyond your contributions when used for education expenses.

- No FAFSA Reporting: Roth IRAs are not required to be listed as assets on the Free Application for Federal Student Aid (FAFSA). This omission can potentially lower your student aid index, improving your eligibility for federal and institutional financial aid. Maximizing financial aid opportunities can be a significant benefit.

529 Plan Considerations:

On the other hand, when comparing Roth IRAs to 529 plans, some considerations arise:

- 529 Plan Reporting: If you hold a parent-owned 529 plan, it must be reported as an asset on the FAFSA. This can impact your student aid eligibility by potentially increasing your Student Aid Index (SAI).

- Tax-Free Growth: While 529 plans offer tax-free growth for qualified education expenses, they lack the flexibility of Roth IRAs when it comes to non-qualified expenses. Withdrawals that don’t meet the criteria for qualifying education expenses may incur penalties and taxes.

Roth IRAs offer unique advantages, including flexible withdrawals, penalty waivers for education expenses, and no FAFSA reporting requirements. These benefits can enhance your ability to fund your college education effectively.

However, 529 plans provide the advantage of tax-free growth for qualified education expenses. Still, they come with the requirement of reporting as an asset on the FAFSA and potential penalties for non-qualified withdrawals.

Why a Roth IRA Is Best Served for Retirement

While Roth IRAs offer several advantages for college funding, it’s essential to understand their limitations and potential downsides:

Tax on Earnings

One significant downside is that the earnings within a Roth IRA, which would remain untaxed in retirement, become taxable income if withdrawn for educational expenses. When you use a Roth IRA for education, you can withdraw your contributions without penalties or taxes, but the interest earned will be treated as taxable income. This can diminish the tax-free growth benefit of a Roth IRA, potentially defeating its primary purpose.

Diminished Retirement Growth

Another major drawback is that tapping into your Roth IRA for college costs means sacrificing the long-term growth and compounding interest potential of these funds. By withdrawing these dollars for education, you miss the opportunity for your investments to grow over time. If left untouched, your Roth IRA could potentially provide a more substantial nest egg for retirement, offering greater financial security in your later years.

Impact on Financial Aid

Using a Roth IRA for college expenses can impact your eligibility for financial aid. The contributions and interest you withdraw must be reported on the Free Application for Federal Student Aid (FAFSA) two years after the distribution. While these funds may not be considered taxable income, they are counted as income for FAFSA purposes. This can increase your Student Aid Index (SAI) and potentially reduce your eligibility for federal and institutional financial aid.

In summary, while Roth IRAs provide a versatile savings option for college funding, they come with notable downsides. The taxation of earnings when used for education, the loss of long-term growth potential, and the potential impact on financial aid eligibility are important factors to consider. It’s essential to weigh these drawbacks against the advantages and carefully evaluate whether a Roth IRA is the best choice for funding your education expenses.

Why a 529 Plan is Best for Education Funding

While not without its imperfections, the 529 plan offers numerous benefits that may make it a preferable choice over a Roth IRA for families seeking effective education funding solutions. Here are some key advantages of 529 plans:

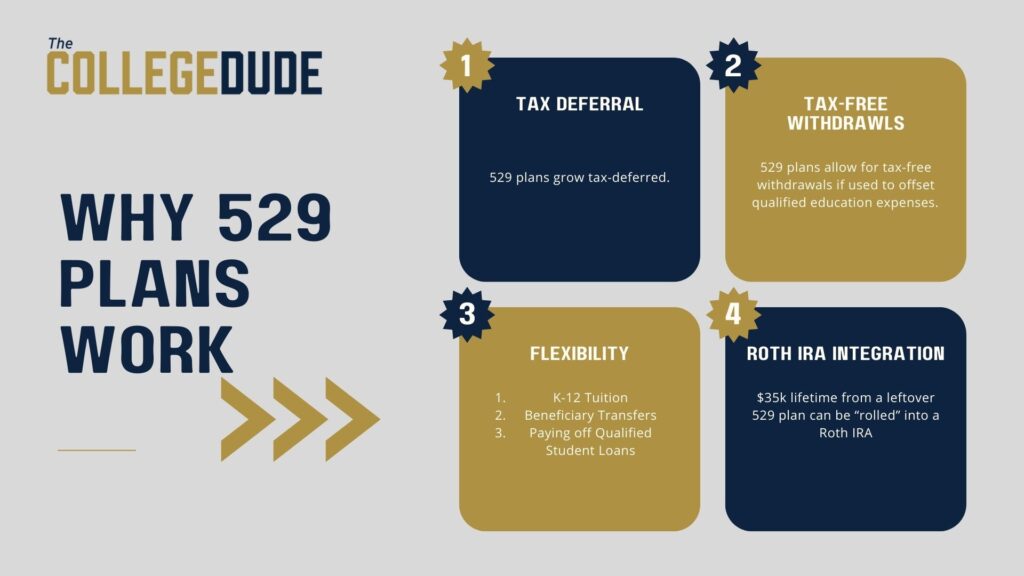

Tax Deferral

One of the primary benefits of a 529 plan is tax deferral. Contributions made to a 529 plan can grow tax-deferred. Again, this means you won’t pay taxes on the earnings as they accumulate. This tax advantage can help your college savings grow faster over time.

Tax-Free Withdrawals

The real strength of 529 plans lies in their ability to provide tax-free withdrawals when the funds are used for qualified education expenses. This includes expenses such as tuition, room and board, books, and more. Tax-free withdrawals can significantly reduce the financial burden of funding higher education.

Enhanced Flexibility

Over the years, 529 plans have become more flexible, offering additional options to account holders. For instance:

- Paying Off Student Loans: You can use unused funds in a 529 plan to pay off up to $10,000 of eligible student loans in your lifetime without penalties.

- Beneficiary Transfers: 529 plans allow for penalty-free transfers of the remaining balance to different beneficiaries, offering flexibility in how the funds are used.

- K-12 Tuition: You can utilize a 529 plan to cover qualified tuition expenses for K-12 education at private schools, expanding its usefulness beyond college.

Integration with Roth IRAs

Thanks to the Secure Act 2.0, you now have the option to transfer unused 529 plan funds to a Roth IRA. This integration allows both accounts to work in tandem, offering potential tax advantages and financial planning opportunities.

In summary, while the 529 plan may not be perfect, it provides significant advantages over a Roth IRA for families focused on achieving their education funding goals. These advantages include tax deferral, tax-free withdrawals, increased flexibility, and the ability to integrate with other savings accounts. Careful consideration of these benefits can help you make an informed decision about the most suitable college savings strategy for your family.

Why Coordinating Accounts is Necessary for Success

In conclusion, it’s crucial to recognize that there’s no absolute winner when it comes to choosing between 529 plans and Roth IRAs for your financial goals. For education savings, I believe 529 beats a Roth IRA when saving for college. But rather than comparing the two for one instance, consider the full financial picture. It should instead be about crafting a comprehensive strategy that aligns with your unique circumstances and objectives.

529 plans are specifically tailored for educational expenses, while Roth IRAs are primarily designed for retirement savings. However, the power lies in their versatility. By employing both these financial tools strategically, you can aim to minimize your tax liabilities within the bounds of the law.

The goal should always be to meet your legal tax obligations while avoiding unnecessary payments. Achieving this requires a well-thought-out financial plan designed for success. By doing so, you can harness the combined potential of 529 plans and Roth IRAs to fund education and secure your retirement.

In essence, it’s about leveraging these accounts in the most tax-efficient manner to achieve your dual objectives: funding education and building a solid retirement nest egg.