When it comes to saving and specifically PAYING for college, it’s vital to have a budget. With any good plan, it’s ideal that a project come in under budget, but life doesn’t always happen that way. Budgeting for college can feel like a challenge, but knowing the sources in which you should utilize can help. In order to come in at or under budget, you need to have a budget to begin with.

What makes up the budget

So what should the budget consist of? I generally advise in 5 places. These sources will allow families to stay on track for other goals, such as retirement & being debt-free. Equally important, it can allow the student to get off to a great start. By focusing on these sources, the student and parent alike can plot out a successful college career without crushing student loan debt.

Scholarships and Grants

Scholarships and grants come from the school directly in the financial aid package, or from outside sources. Commonly, scholarships can be found from scholarship coaches, websites, guidance counselor offices, or this new website called google.com. Those options won’t be a fit for everyone, but you should consider each of them – as they can benefit. The scholarships from the schools can also be found on the school website. Be sure to note if they’re competitive scholarships or automatic. If automatic, scores will allow for the student to qualify. If competitive, it could be likely, but no guarantee. Lastly, for grants, check through your state’s education agency if you’re eligible for some grants. These are often awarded on need, but many need to be filled out and completed.

When budgeting for college, the sources that don’t have to be paid back or are provided by others should always be maximized.

NOTE: Scholarships in excess of tuition, books, and equipment are considered TAXABLE. But I wouldn’t fret too much – having (a) scholarship(s) in excess of these expenses mean(s) you probably did something right.

Tax Credits

The 2 most popular federal education credits are the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC). If you’re a parent of a dependent, undergrad student, and you’re eligible for both credits, the AOTC will generally offer the better benefit. For anyone not eligible for the AOTC, the LLC is a good fall back option.

Of note – Make sure you properly utilize the type of expenses for these credits – as the qualifying education expenses include, tuition, fees, books, and equipment – NOT room & board.

You also want to make sure you’re aware that you cannot use “tax-favored” funds to cover expenses, then qualify for the credit. For example, you cannot fully fund tuition from a 529 plan, then claim the AOTC or LLC, as the IRS considers that “double dipping.”

For the AOTC, you can get up to $2500 back in credits per child, per year. The key is keeping MAGI below $160k is married filing jointly. If head of household, single, or qualified widower, the max benefit is available is to MAGI under $80k. Married filing separately filers aren’t qualified for this credit. The credit will phase out for incomes $80k-$90k ($160k-$180k MFJ), and is no longer eligible to MAGI earners over $90k ($180k MFJ).

NOTE: If you’re unsure your MAGI, line 11 of the IRS 1040 shows your AGI. If you’re close or near to this amount, check out some simple ways to lower your MAGI in the blog post below.

Savings

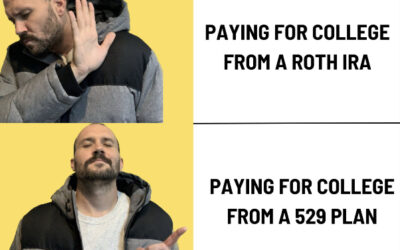

If you’ve saved for college, you’ve likely saved in a 529 plan, as it’s become the most popular savings vehicle for college. And for good reason – these vehicles can offer state tax deductions on the front end (check your state’s rules for more info on that), the plans grow tax-deferred, and distributions to cover qualified education expenses are tax free!

But there are also other sources parents have saved in – such as non-qualified brokerage accounts, savings accounts, and even Individual Retirement Accounts (IRAs). You should be aware of the tax consequences and risk associated with each of these accounts. By including these sources in your plan when budgeting for college, you should not have these earmarked for other sources, such as an emergency fund or intermediate purchase.

Cash Flow

Perhaps you have expendable income each month. If you do, that’s great! Utilizing some of that to help pay for college can be a great way to avoid debt for you and your child. What are some sources? First and foremost, you should do an audit of your budget – and research how much you’ve been spending on your child while he/she was home. While you recognize a cost savings while your child is in school? If so, consider utilizing those funds.

How about old subscriptions you may no longer be using? I find that those tend to go by the wayside for some parents when their child is in school. Consider utilizing the extra room in the budget to help pay for your student’s education.

Favorable Student Loans

How do I define favorable? Low & Fixed interest, (potentially) forgivable debt, deductible interest, and friendly repayment terms. The federal student loans generally fall into this category, but note that many state agencies can also offer student loan debt like this. The Direct Loans in the student’s name will have those characteristics, but for many parents, they can help supplement, but won’t cover, the full net price. Make sure you do your research on the other loans available to you.

Conclusion

Paying for college is daunting for parents and students alike. The best way to take on this task is by budgeting for college as a starting point. There are other steps you need to take, such as building out your school list, running net price calculators and visiting the schools. Unfortunately, expensive mistakes can happen. Avoid those by communicating with your child and getting on the same page. If you’re still feeling lost, working with a professional can help alleviate some of the worry and set you up properly.