by Danny Cieniewicz | Feb 16, 2023 | Financial Aid, Saving for College

If you’re the parent of a student, you know that the cost of education can be a significant financial burden. A simple bit of research will verify this thinking for you. That’s why financial aid is so important, but it can be discouraging to receive a...

by Danny Cieniewicz | Feb 14, 2023 | FAFSA, Financial Aid

High school guidance counselors are responsible for providing a range of essential academic support services to their students. Most schools employ several counselors so that they are able to best serve a specific number of students. Typically, they provide a number...

by Danny Cieniewicz | Feb 13, 2023 | Financial Aid

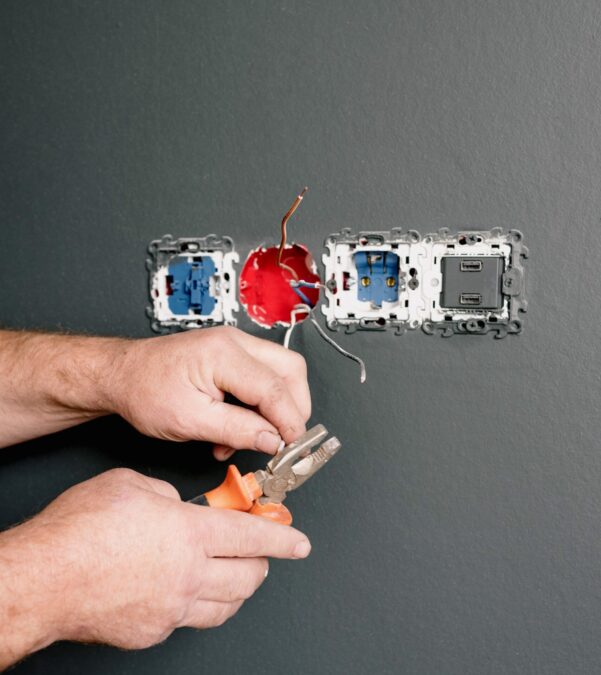

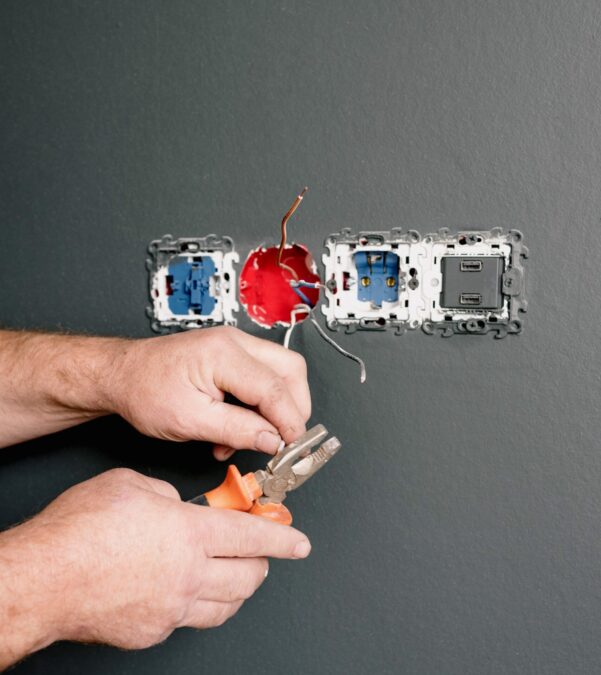

Trade school is an excellent way for students to gain specialized skills, which can lead to a secure career in the long term. But students often face a difficult decision: financing their trade school education by taking on considerable student loans. This post will...

by Danny Cieniewicz | Feb 11, 2023 | FAFSA, Financial Aid

Financial aid can be a great way to help fund your child’s college education. But what steps do you need to take in order to determine your child’s financial aid eligibility? To get the most out of the financial aid process, it’s important that you understand how and...

by Danny Cieniewicz | Jan 27, 2023 | Financial Aid, Student Loans

Should I refinance my student loans? A question that depends on so many factors… Let’s start with some basics. First, let’s make the distinction between Direct Loans(federal loans issued directly by the US Dept. of Education), and private loans, which are issued...

by Danny Cieniewicz | Jan 12, 2023 | FAFSA, Financial Aid

The cost of college varies depending on the type of institution, location, and program of study. On average, a public four-year college in the U.S. can cost $10,000-$30,000 per year, while private colleges can cost upwards of $80,000 or more per year. But don’t...