Student loan refinancing can make sense for a certain segment of the population. But the type of borrower profile is specific. Federal student borrowers have tremendous benefits compared to private borrowers. It’s important to make sure that you’re weighing the pros and cons of this decision. As the federal student loan repayment pause is ending, let’s cover who is a good candidate and more importantly, who is not a good candidate to consider student loan refinancing.

What is Refinancing?

Student loan refinancing involves taking the current balance of your loans and applying for a new student loan. By refinancing the loan, you could be combining several loans into one. The current loan(s) is/are paid off and a new loan is created. By refinancing, usually the goal is to do one or several things:

- It could be to lower interest.

- It could be to spread out the amount of time that you have to repay, thus lowering your payment.

- Or you could be refinancing to a shorter time period to pay the loan off quicker and minimize the amount of interest that you have.

Something that you must be aware of though when it comes to student loan refinancing is that many times refinancing is going to be done through private banks and through private institutions. There can be some opportunities where this does make sense. One such instance would be when parents who have PLUS loans want to transfer the loan to the student/child. However, as we’ll cover in this post, you could be giving up serious benefits.

What Are the Downsides?

However, something that you also want to be aware of are the downsides to refinancing. If not well thought out and researched, there are quite a few potential problems. To consider student loan refinancing, the first consideration is what type of loan you have.

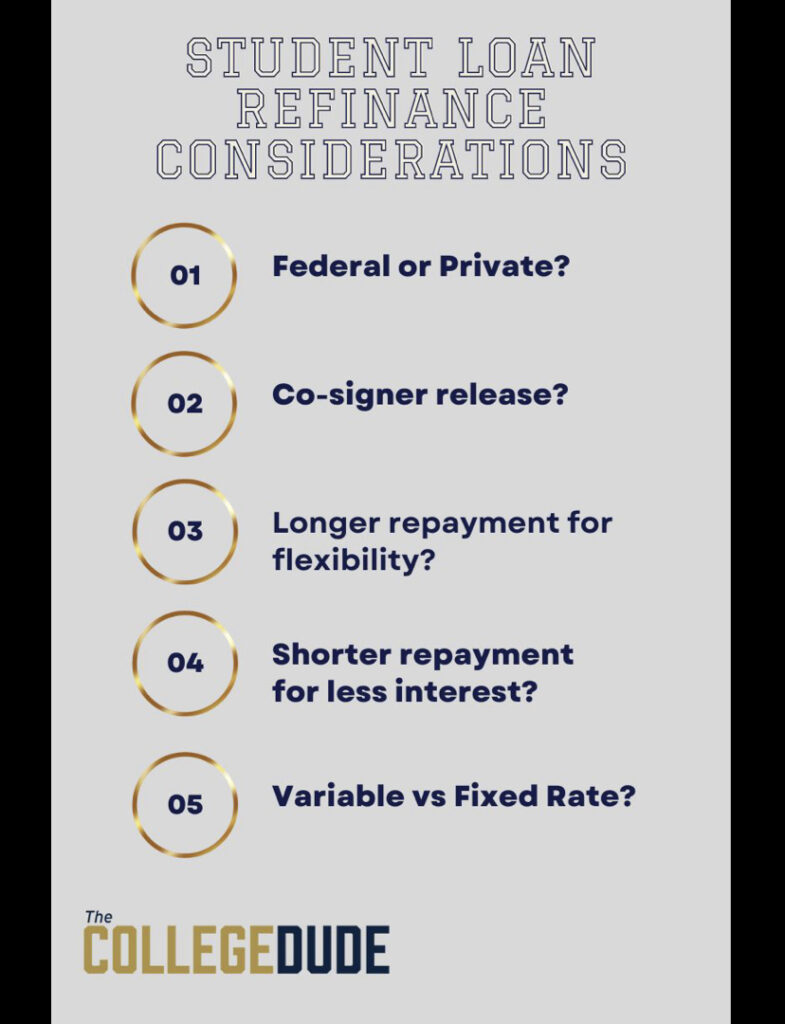

Federal vs. Private Student Loans

So if you have Direct Loans (otherwise known as federal loans), you need to pause and assess. Whether those be Direct subsidized or unsubsidized loans, Direct Parent PLUS loans, Direct Grad PLUS loans, etc., you want to make sure that if you consider refinancing that you know what you’re giving up.

Repayment

The first benefit of the federal loans are access to an income driven repayment plan. There are 4 main income-driven repayment plans for student loans, and these plans vary in who they’re best for. These income-driven repayment plans are based off of your adjusted gross income. The lower your income, correspondingly, the lower your student loan repayment. In nearly every private loan, the payments will be fixed. You need to understand how the repayment is going to work, if and when it could be tied to your income.

As a result, if you have a lower income or are anticipating that you’re going to have a lower income, you want to be in a position where if you’re giving up the federal for the private refinance, that you’re well aware of this.

Forgiveness

While some private loans can be forgiven, they are few and far between. They are also more likely to be state agency based, or profession-specific. It’s incredibly rare that a private student loan servicer could offer it directly. For federal student loans, they’re written into the promissory notes directly.

There’s a standard forgiveness schedule, which is going to be based off the type of income driven repayment plan that you were in. But one of the more popular ones that’s out there at the federal level is public service loan forgiveness. By refinancing from a federal to a private loan, you are then taking away the ability and the eligibility to be into public service loan forgiveness.

If you’re going down the refinance route, you want to make sure that public service loan forgiveness is not an option for you. It can be a tremendous benefit and a great way in which you can have loans that are forgiven in just 10 years time or after 120 qualifying payments.

Discharge Options

Federal loans are discharged specifically with death and disability upon the death of the borrower. Depending on the type of federal loan, that could include the death of the parent or student borrower. The same criteria applies for total permanent disability of the borrower.

While discharge may be common for some private loans, it may not necessarily be the case with every single private loan that’s on the market. It’s important to make sure you read the promissory note of the contract. By understanding what is in the contract, you can have a better idea of how to make sure a loved one isn’t saddled with your debt.

Variable Vs. Fixed Interest Rates

One of the positives of refinancing is to consider a lower interest rate. Often times, this is the case for many borrowers who started with higher interest rates. But you should be aware of what type of interest rate you’re refinancing into.

Federal loans have fixed interest rates. Depending on the type of private loan you refinance into, they could be variable interest rates. In a rising interest rate environment, you will notice that those variable interest rates are going to increase, thus increasing your monthly payment. Be aware of what you’re getting into before you sign off on the dotted line.

Who Should Consider Refinancing

Private student loan refinancing can be a smart financial move in certain situations. If you currently hold a private student loan and are exploring the idea of refinancing it into another private loan, here are some factors to consider:

- Cosigner Release: One compelling reason to refinance privately is if you have a cosigner, like a parent, and they wish to be released from their obligation. After building a strong credit history over a few years, you may become eligible for refinancing at a lower interest rate, allowing you to remove the cosigner.

- Lower Monthly Payments: Refinancing can lead to reduced monthly payments, making it easier to manage your finances.

- Payment Flexibility: You can also extend the repayment period if you need more flexibility within your budget.

These are all valid reasons to explore private loan refinancing. However, it’s crucial to exercise caution when considering refinancing federal student loans. For those with private student loans, it makes more sense to consider student loan refinancing.

If you’re thinking about transitioning from federal to private loans, be aware that you could forfeit valuable benefits. Federal loans, including Federal Grad PLUS Loans, are part of the direct loan system. They can be consolidated, offer income-driven repayment plans, and are eligible for various forgiveness programs, including public service loan forgiveness. Additionally, they can be discharged in the event of death or disability.

If you’re contemplating switching to an income-driven repayment plan, it might be more advantageous than refinancing into a private loan.

Conclusion

In summary, assess your current loan situation and create a pros and cons list before making any decisions about refinancing. If you have private loans, refinancing may be a suitable option. However, if you hold federal loans, proceed with caution and explore all available options thoroughly.