The question presented is one that I see quite a bit for many parents of adolescents today. First, let’s look at the landscape. College is expensive. REALLY expensive. It’s darn near impossible to cash flow or save for four years of school for a child, let alone multiple children. So that is one factor. On the flip side, student loan debt isn’t going anywhere. The millennial generation may as well be referred to as the “student-debt generation.” The next generation upcoming (Gen Z) is no different. So what should you do? Can you do both? Should you be prioritizing saving for college or retirement? The question requires knowledge, planning and your own personal feel.

The Problems

In the United States, our system of federalism is super complex. Let alone the politics of 50 states making one country. But we have 50 different state tax rules. Completely different areas within states that make up varying levels of cost of living. Different communities made up of different people with differing goals. So is there really any standard advice that’s out there? You must first define what it is you want. Do you want college for your children? Do you want to help them in any way (assuming you can)? How important is retiring to you? Are you currently on track for financial independence? Before you decide if you’re saving for college or retirement, maybe you need to decide what each look like.

Retirement

Unfortunately, I’ve met some people who are not ready to retire. And they are in their late 60’s or early 70’s. It’s something that eats at me. Sometimes, individuals put themselves in these predicaments, with a lack of planning, poor life choices, a “Keeping Up w The Kardashian” lifestyle. I would say that I feel for them, but there’s only so much pity I can give to someone who voluntarily shoots himself in the foot repeatedly.

But we also have individuals who may have made poor choices that were not of their own accord. Perhaps someone went through a nasty divorce with an unfaithful spouse. Perhaps someone or a spouse was the victim of a disability or traumatic health event. Worse yet, the loss of a child or having to leave a job to care for a sick child. These are individuals who any kind-hearted person will recognize needs some level of help and assistance.

Regardless of the circumstance, seeing individuals that are forced to work to make ends meet in their golden years is something I try with all my power to avoid.

But the question must be asked by any couple or individual in his/her golden years who wants to retire: Do I have enough? Can I make it? The stress is real, even for some who may have $1 million in a 401(K). It’s about more than just how much does one have saved. As we see with a similar problem with college, it’s how much is one spending.

Saving For College

I have personal experience when it comes to paying for college and student loans. I’m one of 6 children, and my parents would be classified as middle-class by any economist you meet. They love me and each of my siblings unconditionally, as proven from the time spent with us by a mother, and providing for us by a father. But to expect to pay a $40k+ bill per year for six kids? Nah, ain’t happening.

I enrolled in 2008, 15 years ago. I can officially say I am getting old knowing that (kidding!), but one thing that is not up for debate is the cost of college. Per this U.S. News & World Report graph and article, you can see what’s happened since the turn of the century.

Yet, everyone continues to want to attend college or go to school. Should they? Maybe. Maybe not. That’s a discussion you need to have with your child – and frankly, probably one you should have with a third party. But we all know the problem with student debt. It can cause children to move back in with parents, often times longer than either want. It hurts the chances of individuals getting a car loan, mortgage, or saving for other goals. Some younger single individuals want to know if their potential partner has student loan debt before considering getting serious! I’ve long believed in the vow “til death do us part,” not “student debt means no start.”

We can do better as a society. We must do better as a society. I believe strong families make strong communities, and strong communities make strong countries. But worrying about debt bringing us down due to other long term goals quite literally ruins the foundation of any solid financial plan. This is true whether saving for college or retirement.

The 3 Questions we must ask

For a good number of Americans deciding between saving for college or retirement, there are similarities. But I think anyone with a family must first start at a more fundamental level. I think each of us needs to ask a foundational question, and then 2 necessary follow up questions. If we can’t answer these, then we are unlikely to be oriented where we should be. I think many people fall victim to an unclear direction, and unclear direction leads to inaction, lack of focus, and ultimately, it leads to failure.

Instead, ask yourself this question – what is it that I want?

I think this question needs to be asked of yourself first, then for your child second – what is it that I want for my child?

My Answer

Let’s start with our own question. If you ask me, my wife and I have differing answers on some of the periphery, but overall we’d agree. I want a job I never want to retire from, but can eventually at any time. I want to have saved enough that allows for assets to create income, not my ability to perform a service. To be able to, at the drop of a hat, take my wife out to eat or on vacation. Raising a family is very important to me, and providing for them is my number one priority…until they reach the age of maturity…which is when I want them to have the knowledge, skillset, conscience and foresight to do it themselves and with their life partner (should they so choose).

In other words, I want independence for my family. I want autonomy over my life. I think having financial freedom is the clearest way to achieve that. This applies to both saving for college or retirement.

That’s my goal. What about for my child(ren)?

What We Want for our Children

To me, a successful parent can be defined as someone who makes a successful parent. Now, don’t get me wrong, I recognize it’s a circular definition and that’s not all encompassing. But I take parenting seriously of my own child since I know how good I had it from my parents.

Simply put, I want to provide the help, support, shelter, and basic means of survival, while also empowering my child to spread her own wings when she’s ready in time. I refuse to do everything for her, but will do anything for her she can’t do herself.

How that relates to college? Well I need to know if it’s something she wants and needs. My wife did not go to college, and she’s as successful an individual I know. But my daughter may choose a different path. But I want to make sure it’s her choice, and it’s well thought-out.

The Follow Up Questions

After the “want” questions, (and I think we need to spend a lot of time answering that question) I think there are 2 necessary follow up questions.

- Am I currently on track?

- What’s stopping me or my child from getting there?

Without a doubt, this is where the planning comes in to play. Some can do this themselves. Some may need to pay an advisor (hello, there!) to help. Either way is fine – so long as you get there.

But what I’ve seen trip up so many people is the college and retirement conundrum. It’s so often a one or the other:

“I’ll start saving for retirement when Junior is through school.” – When has this ever worked?

“I can take out loans for college, but not for retirement.” – What if the loans for college set you off retirement or Junior needs to move in long term to pay back the loans? Does that delay retirement?

“We’ll send him to a state school.” – This could make sense. But does it match his academic, social and geographic fit?

We must stop doing the things that don’t work. Delayed retirement and crushing student loan debt is not the answer.

Can you do both?

Yes. You can. It’s an “and” answer, not a question of if I should be saving for college or retirement.

While I should leave it at that, I want to expound a bit. If you own a home, there’s a very high likelihood at one point or another, you had a mortgage. 2008 housing crisis notwithstanding, the process to obtain a mortgage on your home was likely a lengthy one. It requires the gathering of financial documents, credit checks, a look to your spouse with a bewildered look and asking: “we’re paying what on our new home?!”

In other words, it’s a process. It’s not something you achieve overnight. And it shouldn’t be! It’s one of the largest outlays (if not the largest) you and your spouse will make. Outside of taxes, a mortgage is very likely to be the highest cost item on a monthly basis for a middle class family. So you should be taking the time to answer that question.

But you do realize financing retirement is very likely to be a greater expense, right? I mean, having assets create income for you and possibly a spouse for as long as you guys live? You have to put time into that. What about college? For some, a home may cost more than their college education. But not everyone. At a minimum, college can be a six-figure outlay per child. You should be going through the same pain of preparation for college prep as you do for a mortgage. Just less paperwork…

Retirement

I’m going to keep this high level. But are you currently saving for retirement? Do you know what your social security payouts will be? How about the taxes you’ll owe in retirement? Do you have enough to withstand an emergency? Have you recently checked your allocations inside your investments?

These are all questions that many financial planners will ask you, and if they aren’t asking you those, you probably need a new financial planner (hello, again!). But these should not be the first questions being asked. Question 1 – what does retirement look like to you? For some, they love working in retirement. I hope to be that person someday. But not full time, and completely on my terms. For others, they want to live on the golf course or at the beach. Totally cool with that!

Question 2 – have you budgeted? If you understand sports, a great analogy is offense and defense. A great offense can mean boatloads of cash flowing in. But a poor defense means boatloads going out. Which means your financial plan and subsequent retirement plan could be high scoring, but part of a losing strategy.

College

Let’s apply the same logic to your college payment plan.

Question 1 – what does college look like to you? The other follow up questions you should be considering: Do you plan to pay for all your child(ren)’s college? Are you able to? Should you? Do you think they should have “skin in the game?” Do you feel like this is their decision and path or is it yours?

Question 2 – have you budgeted? This one is a bit trickier than retirement planning, cause there’s more nuance here. What are the sources you’re using to pay for college? Have you run any net price calculators at any of the schools on your child’s list? Do you expect him/her to get scholarships? Are you in any way familiar with the types of student loans on the market?

Thinking about these questions and having a solid answer to both saving for college and retirement will allow for you and your child to get through unscathed.

Your Plan

Finance and fitness have so much in common. For some, intermittent fasting is great. For others, a Roth IRA makes no sense. Universally true, fresh air is a must. No one ever got wealthy with serious credit card debt.

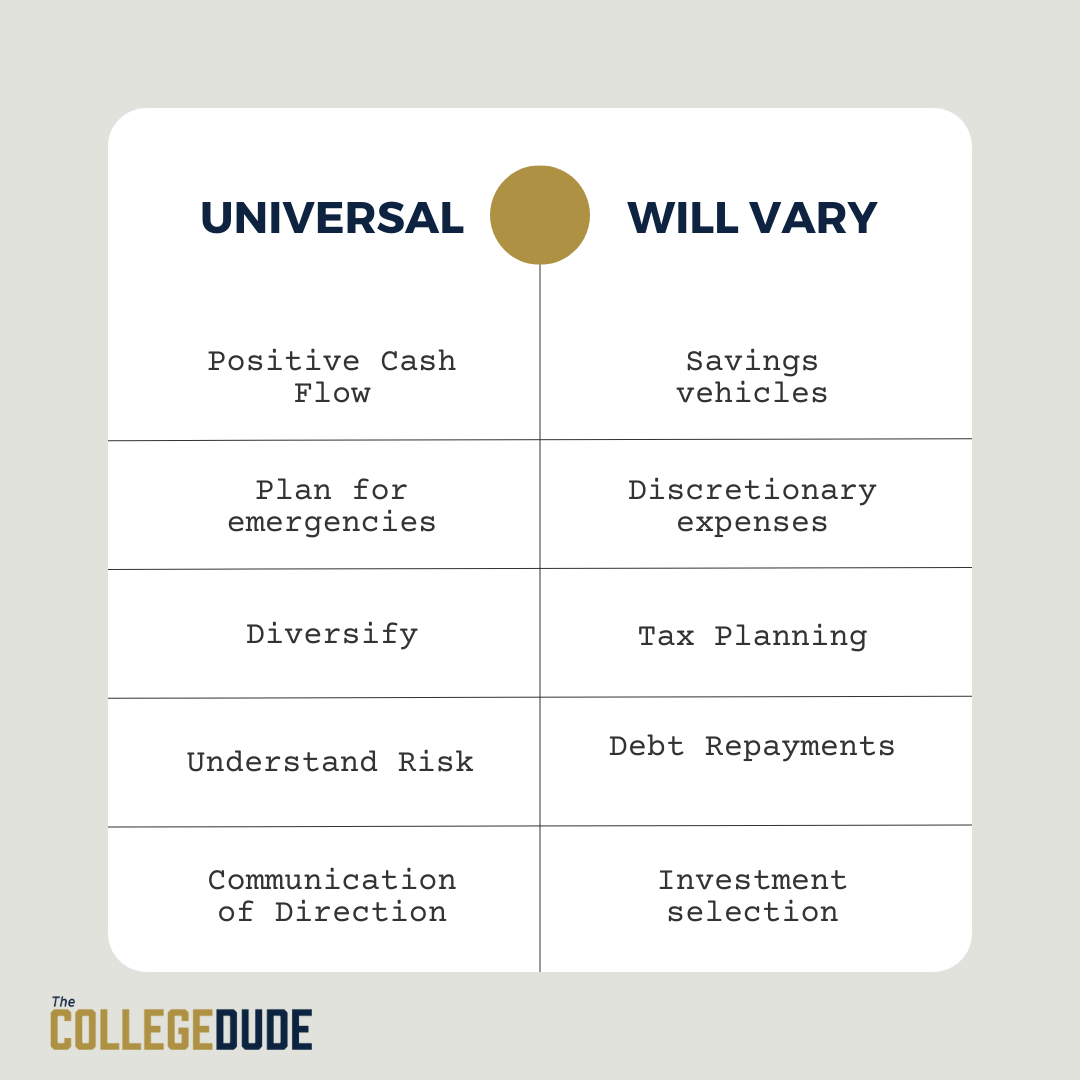

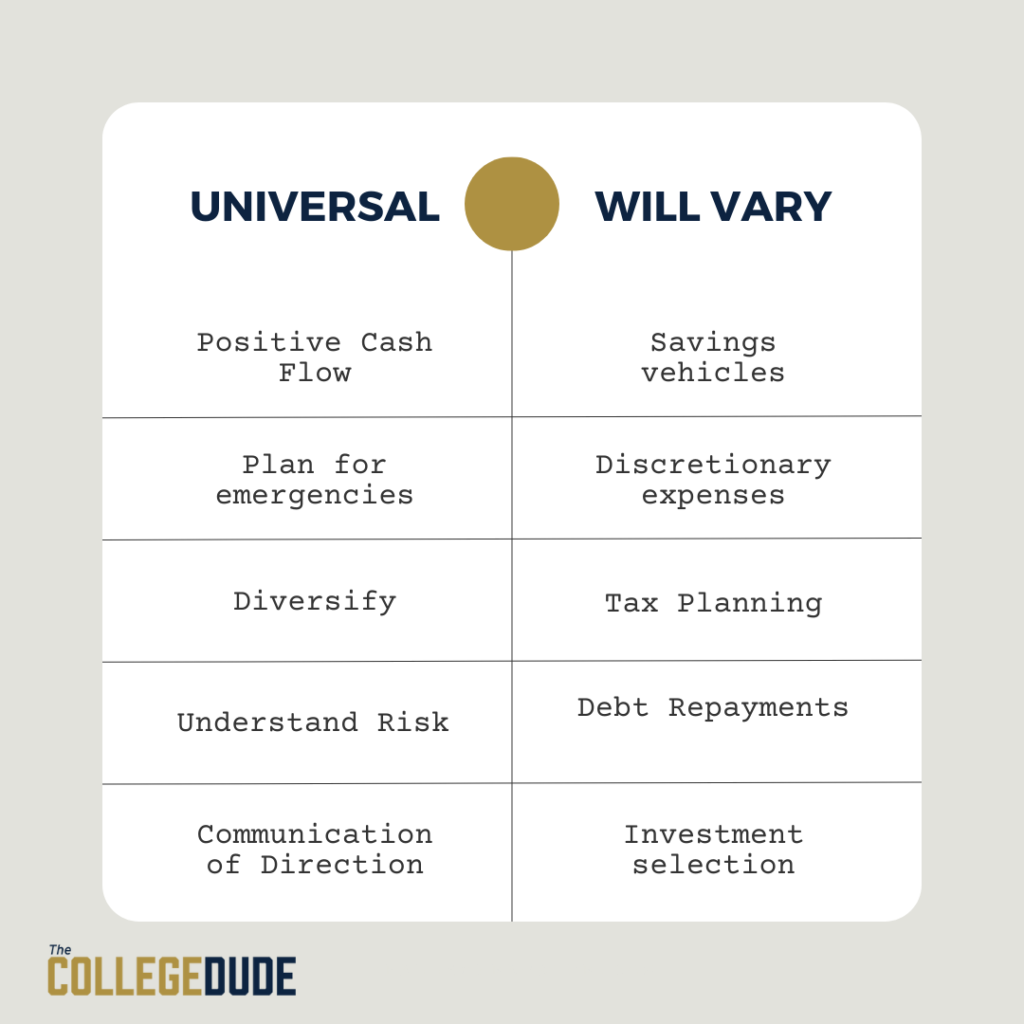

There are universal truths, then there are matters of preference. We must make sure we discern between the two, whether talking about saving for college or retirement. I think this image may be helpful to breakdown the differences:

Universal Financial Truths

Positive Cash Flow

This may appear obvious, but there’s a reason why. It doesn’t matter at which stage you are in life, positive cash flow is essential. Retirees often ask: “Do I have enough to retire?” It’s answered if you can have positive cash flow to sustain the rest of your life. It’s hard to project when you’ll pass away, or the risks you’ll face, but it can be projected with high accuracy.

Even if you’re living paycheck to paycheck (aka, breaking even), it’s better than racking up credit card debt. But it’s ideal to give yourself a buffer because the minute you begin to get comfortable living paycheck to paycheck, something comes up. And when it does, you’d best have a plan for it.

Plan for Emergencies

Every single person has had an unexpected expense occur. There are typically 3 ways to handle them. 1 – create an account for specific emergencies. An example would be my “car” savings account. My car has needed new tires (unexpectedly), been an an accident and needed to use a deductible (unexpectedly), and always seems to need something fixed when I take it in to get inspected. By keeping that account padded, I can withstand the unexpected. The second alternative is to keep a chunk of cash in a savings account for all general expenses. The more cash you hold, the better this could be. But be ready for emergencies that could pop up in all sorts.

The last way is to put it on credit. High interest rates that compound quickly are a good understanding as to why this is an undesirable route.

Diversify

This doesn’t just include your investments, but it does include your investments. We often hear “diversify” and think of our pie chart (aka asset allocation) inside out work retirement account. And yes, you want to keep that thing diversified. If one sector or stock tanks, it causes the entire portfolio to go with it if it’s over weighted.

But you should also diversify your income. If you’re solely reliant on one person’s income within the family, can you withstand a death/disability to that person? Do you have other sources by which to draw if the unexpected occurs?

What about taxes? Can you withstand a tax increase of some sort? Can your portfolio?

Families who have diversified financial planning are usually always apologizing for something. Perhaps you own a diversified portfolio and tech stocks crash. That’ll affect your portfolio. But you won’t lose your shirt.

Perhaps you have disability insurance for the breadwinner. If he/she never goes on claim, you’re out those premiums you spent all that time.

Perhaps you’re in a far lower tax bracket in retirement than you were while working, yet you contributed to a Roth IRA.

Maybe when it came to saving for college and retirement, you overshot one more than you should have.

Each of those examples may cause you to have to “apologize” for the end result. But if you hadn’t put those examples in place, and the alternative where to happen, then what?

Understanding Risk

Risk is far more than a market correction. People will say I can’t be too risky at my age, if I see a crash I won’t recover. I don’t disagree with that statement one bit. But some of these same people don’t have legal documents in place, or proper home and auto insurance coverage.

The most successful investors and financially literate understand risk is a part of life. Managing, mitigating, removing, and accepting risk is what the best do. A young couple should risk their retirement portfolio, cause it’s not to be touched for 30+ years. A 64 year old who has saved enough to “retire” can risk not having disability insurance. But that advice to the contrary is flipped for both demographics.

All risk cannot be fully eliminated. But hedging risk to your advantage is something a winning financial plan has across the board.

Communication of Direction

You can have the college budget completely filled out. A work of Picasso, if you will. No student loan debt for mom, dad, or Junior. That’s fantastic. You’ve answered the call to either saving for college or retirement. Way to go!

But if Junior is headed to the big state party school and enjoys football games, tailgating and video games more than his academics, that could spell doom. The state school could be the most affordable option. But how affordable is it if he needs to transfer? What if all the credits don’t transfer over and he needs to stay an extra semester (or two?). Was that choice the most profitable compared to the small, private school that required minimal, manageable loans?

The most successful marriages, partnerships, workplaces, organizations thrive on two things – trust and communication. If I cannot trust my wife with her Target spending habits, how can we be successful? If I cannot communicate to her I want to save up for an expensive vacation, how can we make this work?

It’s a great idea to be clear on the direction of your family – whether saving for college or retirement, or in general, to avoid the unforeseen and have resentment creep in.

Varying Factors of Financial Success

Savings Vehicles

529 Plan, UTMA, or Roth IRA to pay for college? Should I do a Roth conversion this year? Social Security at 62, right? I can find something that allows me to accomplish saving for college and retirement, right?

These questions are the ones I enjoy tremendously – cause there is so much nuance. But there is typically a right answer…for a family. I generally don’t care for the idea of a Roth IRA to pay for college. Does that mean it’s wrong for everyone? Of course not. But in our polarized world, opinions are shared and eventually become dogma.

The IRS gives beneficial tax treatment to taxpayers of a certain income dynamic, age, and stated purpose. Go beyond those dynamics, and a penalty is usually involved. By focusing on the plan and planning, one account can make a lot of sense for families, while another can be disastrous.

Discretionary Expenses

I also enjoy this one quite a bit. I have some friends who love to travel. My best friend was recently in Thailand, Iceland, and traveled to Colorado recently. I live in Pennsylvania and rarely leave. My wife thinks that anything north of the George Washington Bridge is considered a faraway land called “Ca-na-da.” We don’t have a travel budget. Others do.

But what we do love to do is good food. Our food budget would make money blush. I don’t look at someone’s budget with judgment or disdain, though so many of us do. “Can you believe so and so spent $600 eating out last month??” Okay. But they’re also saving more than 20% of their income. In life, we sacrifice. But it’s also okay to enjoy the things we have from time to time. Not to become reliant upon them, but enjoying them is an acceptable thing.

Discretionary expenses should be cut off if need be. If my wife and I needed to cut because of emergencies in the month, that’s okay too. We’re not tied to it. But communication (universal truth of financial success) allows for this.

Tax Planning

One of the most important aspects of financial planning is tax planning. Don’t get me wrong, they’re all important. But minimizing tax while staying compliant with the IRS and your state can be nuanced.

The example of a Roth conversion for a client is a polarizing one. But we need to take into account so many factors, thus creating the nuance. Should you or shouldn’t you do it? There is a legitimate argument to be had either way in many cases, but that perfectly explains why this is a grey area. You can apply the same to the idea if I should be contributing to a Roth or Traditional IRA. Should I use a 529 plan, a UTMA account or Roth IRA for my children’s college?

These are all tax questions – and the answers will vary from family to family.

Debt Repayments

I’m not sure I’ve met an individual who enjoys being in debt. Don’t get me wrong, nearly everyone has to utilize debt at some point, and often times, if managed correctly, debt can provide great leverage toward a fulfilling life. But the strategy to become debt-free varies among individuals.

Some people know that manageable debt is a way of life, and positive cash flow (one of our universal truths to financial success) can still be achieved with debt on your balance sheet. Others, and some very popular radio hosts, cringe at the thought of any debt whatsoever.

In reality, both can see financial success. Life is about sacrifice – so if you’re planning to pay off all debt before saving for retirement, go for it (to be clear, I do not subscribe to this belief personally or professionally). But there are individuals who have found happiness and financial security by doing this.

If we look at college, student loans have dominated the headlines in the last few years. But let’s be clear about something – not all student loans are the same! I’d argue that one student loan that is $300k in balance can provide incredible benefits to borrowers, while another of only $50k can be crippling.

Some loans have forgiveness features included in the promissory note, flexible repayments, fixed interest, deductible interest, etc. The list goes on. Other student loan repayments could be weighing down parents and children alike. To say that all student loan debt should be paid off as soon as possible is lazy financial advice, and you should give serious consideration to asking why that person is shouting that.

Investment Selection

I subscribe to the belief that some investments have historically done better than others. The world’s most famous investor, Warren Buffett, is a famous proponent of “value-investing.” More specifically, he believes in buying ably-managed businesses, that possess favorable economic characteristics. He’s made occasional mistakes, and had some down years. But he’s always seemed to rise above them and get back up.

But if you subscribe to investing in growth stocks, can you still be successful? What if your portfolio is has more weight in pharmaceuticals than technology? I’m not discounting the differences here – there’s a reason I make certain recommendations for clients and it’s backed by data and historical evidence. But these questions are far higher up on the hierarchy of investing needs. By taking care of the consistent saving, you can establish a plan that will allow you to reasonably expect to achieve your goals.

Your Action Steps

If you’ve made it this far, kudos to you. I’ll keep my closing brief. I think there are 4 things you should do to help you in your quest to saving for college or retirement.

- Think of the ideal scenario for you and your child – give some thought to a target for you and your child when it comes to financing college. Do you want to make all the payments? If taking out student loans, do you know how much you and your child will have to repay? Have you had the conversation with your child to getting him/her on the ideal campus?

- Evaluate your retirement planning – first – define retirement. And really think it through. Does it include working? Perhaps part-time? If not, what does it entail? Do you feel confident you’re currently saving enough?

- Check on your emergency preparedness – can you withstand a premature death or disability? Could you take time off work if needed? Could you handle an unexpected health event? What about an act of God ruining your home or car? What if taxes were to jump? Or the market were to suddenly have a Covid-like drop?

- Communicate openly and honestly with those who will accompany you on your plan – If I asked your spouse (without you present), what you both wanted for college and retirement, could he/she answer as you would? If that answer is no – it’s worth getting clear on the answers.

I’m happy to help in any way with these questions. Many people think we just focus on the numbers and rules and ways to save and spend. Don’t get me wrong, we do and we enjoy it. But these conversations are the ones I enjoy way more. If you’d want an extra set of eyes on your plan, you should reach out.