If you haven’t heard, the FAFSA Simplification Act is here. It’s coming with the start of the 2024-2025 school year. You may not be aware, but that school year actually starts in 2023. The FAFSA has previously opened on October 1 of the year prior to the start of the school year. That’s changing, hopefully for this year only, to “sometime in December” 2023. The reason why? The Dept. of Education is busy. Between student loan repayment restarts, the unveiling of a new repayment plan, and the “new” FAFSA opening, much is happening. One of the most impactful changes of the new FAFSA? The multiple student in college situation. In this post, we will talk through the specific FAFSA changes with multiple children in college, and how it’s likely to affect you.

Key Terminology

The FAFSA stands for Free Application for Federal Student Aid. It’s considered by many to be the starting point for financial aid, and many colleges utilize this information to award institutional aid as well. Previously, on the FAFSA, the combination of parental and student income and assets would create your Expected Family Contribution (EFC). That term is officially retired with the upcoming FAFSA. The Student Aid Index (SAI) is taking its place. Conversely, there are numerous changes upcoming. Importantly, one of the biggest is for families with multiple students in college at the same time.

The Old Way

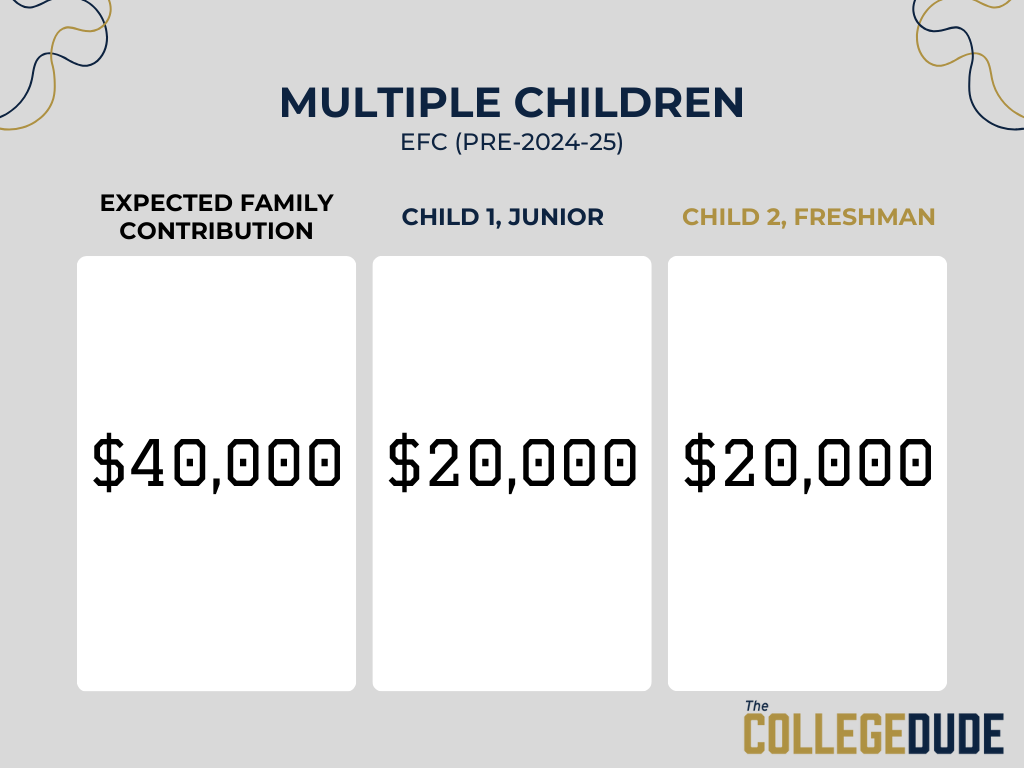

Previously, with more than one student in school at the same time, the EFC would split in half. For example, you can see how this would work with a family with an EFC of $40,000 in the graphic below.

The splitting of the EFC would allow families who have multiple students in school at the same time to have increased access to aid. For example, it’s possible students could have access to subsidized federal Direct loans, rather than unsubsidized. However, the change that’s taking place is removing the benefit that families of multiple children in college at the same time had previously experienced.

The New Way

The passage of the FAFSA Simplification Act has removed the previous student EFC splitting. As a result, the Student Aid Index will be the same for every student in a family in college at the same time. This can especially hurt families who may have twins or triplets! The example of the breakdown is shared in this slide below:

Since this change is taking place, families must prepare for the potential change they will experience.

How Does This Affect Me and My Family?

From a high level, while there are numerous sources of financial aid, two of the largest are federal and institutional aid. Federal aid includes things such as work study, federal grants, and the Direct Loans. The type of aid that is awarded to you depends on your financial need, which the SAI will determine. For example, the federal work study program is only available to students who demonstrate financial need. Too high of an SAI? You could lose this benefit.

Similarly, if you’ve previously received subsidized federal Direct Loans because you received the “multiple student EFC discount,” depending on your demonstrated need, you may only be available for unsubsidized federal Direct Loans moving forward.

This change could potentially affect institutional aid, but that is less clear. Colleges often can award merit-based aid, which is dependent on the student’s merit (test scores, GPA, etc.). These scholarships are unlikely to be in any way affected to a student’s SAI, thus shouldn’t see a change in benefit. Some colleges will award their own institutional need-based aid, however. These grants could possibly see a change, and it’s worth contacting your financial aid office to learn more.

What This Won’t Affect

This change with the FAFSA shouldn’t see any changes with how the CSS Profile awards aid. The CSS Profile is a separate form that schools who utilize the institutional methodology use. As a result, the “multiple student discount” wouldn’t see a change for those schools at this time.

Depending on your SAI and overall financial need, the FAFSA changes with multiple children in college could affect parents, but it’s also conceivable it may not. Ultimately, the college planning process is a nuanced one with the FAFSA Simplification Act creating change and confusion for many. Make sure you’re working with a professional to clear things up.