For many student loan borrowers, monthly payments can be overbearing. For others, the payment is a bit more manageable. What all borrowers should know is that there is potential the interest on student loans can be deducted from income and lower taxable liability. There are some requirements and some things you need to know as a borrower, and you’ll see that covered. In this post, you’ll have a better idea of the student loan interest deduction basics.

The Basics

For starters, this is a deduction (much as the name states). Therefore, you can deduct up to $2500 per year from your taxable income. The good news with this deduction? It’s considered an “above the line” deduction. What makes these deductions great is that you can still claim the standard deduction while adding this one to it.

The loan provider will send a 1098-E every year which will show how much student loan interest was paid in the tax year. But a word of caution – some providers will only send it out if you had paid over $600 of interest that year. In the event you’ve been paying on a student loan but don’t get the 1098-E form, call your provider and request one.

Eligibility Requirements

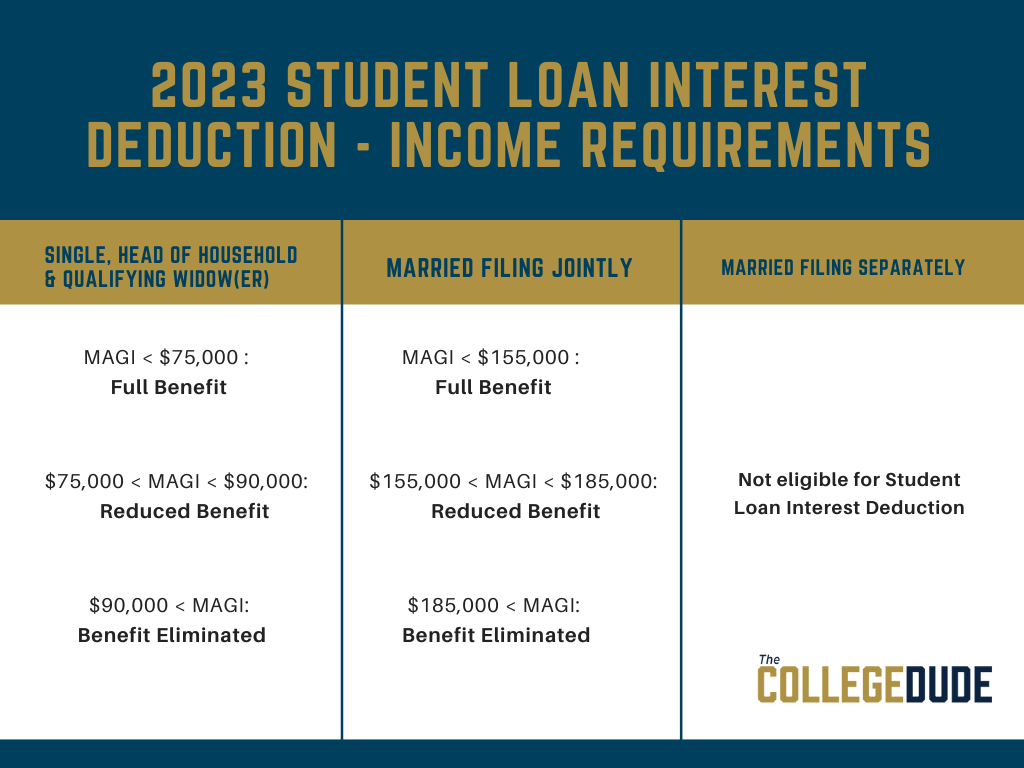

There are some eligibility requirements you must adhere to in order to receive this deduction. The first is that the interest paid on the qualified loan took place during the tax year. The second requirement is that you cannot be married filing separately. You also cannot be a dependent on another individual’s tax return.

There are also income requirements which need to be met. For 2023, they are as follows:

What Loans are Eligible?

The loans eligible must be considered a Qualified Education Loan. This is defined as: “indebtedness incurred by the taxpayer solely to pay for qualified higher education expenses.” [26 USC 221(d)(1)]

Examples of these loans include the following:

- Direct Subsidized & Unsubsidized Loans (Stafford Loans)

- Federal Perkins Loans

- Federal Grad & Parent PLUS Loans

- Federal Consolidation Loans

- State Education Loans

- Student Loans through a Private Institution

Conversely, loans like Home Equity Loans & 401(k) loans are not eligible. Similarly, loans through a family member or friend are not eligible.

Strategies You Could Use to Receive this Benefit

Perhaps you’re close to qualifying for this benefit as a borrower. But you’re just over the limit or in the phase-out income range. Thankfully, there are ways to lower your Modified Adjusted Gross Income. By cutting your MAGI, you can potentially qualify for this deduction and lower your taxable liability. Not only will you be lowering your MAGI, but you’ll also be saving for retirement on a tax-favorable basis.

Conclusion

Student loans are a necessary way for many children and parents to pay for college. Thankfully, there are some benefits available to those of us who have them and are paying the interest. While there’s much planning that can and should be done when budgeting and looking to lower taxes, the student loan interest deduction basics should be known by every eligible borrower.