When it comes to saving & paying for college, 529 plans are a force to be reckoned with. They’re not perfect, but they are as good a tool as you can find. Thankfully, Congress has passed legislation in recent years to further bolster 529 plan benefits. For residents of PA, there are some added benefits that make these plans even better. So buckle up – we’re going to cover the 529 plan guide for PA residents in detail, and how they can best serve families who reside in the Keystone State.

What are 529 Plans?

It’s good to start with an understanding of what a 529 plan is. The plans are derived from the US Federal tax code under…section 529. The plans are administered by states, however. Each state has their own 529 plan, and some have a couple different plans. You’re free to invest in any state’s plan, regardless of your residency. That said, there are important features to be aware of if you do that. Much like we saw in the employer tuition assistance programs, we notice that our wonderful system of federalism is at play. Federal tax law and state tax law will intersect, and we need to be aware of each.

That said, in a simple way to define how 529 plans work, they are tax-advantaged plans. Contributions are made with after-tax dollars, the earnings grow tax-deferred, and distributions are tax-free if used for qualifying education expenses. There can be some nuance to this, so I’ll do my best to unpack everything for you. I do hope the 529 plan guide for PA residents shines a light for you. Specifically at a number of different levels. Let’s start with the different types of plans.

Two Types of Savings Plans

Further breaking down the 529 plans, there are generally 2 types of plans. There are “college savings plans” & “pre-paid” plans. College savings plans are typically invested in the market, which means they are subject to investment risk. You can invest inside a fixed account, which should be guaranteed, but that is typically one option among several. These plans are usually model-based, which means you can pick a model based on your risk tolerance & time horizon. The best part is these plans do allow for you to pay for qualifying education expenses such as tuition and fees, room and board, books, and computers and equipment.

Pre-paid or guaranteed plans work differently. Typically, these plans allow you to purchase college tuition dollars at today’s price. In other words, you’re purchasing the tuition credits with the assumption that the tuition will go up by the time your child is in college. These plans can become a bit tricky if you’re domiciled in one state, but attend college in another state. That said, it’s often the case you can only purchase these plans in your resident state. Each state’s plan varies, so it’s important to make sure you have the facts before you make a decision.

Let’s dive deeper into the specifics with each of these types of plans.

PA College Savings Plans

The first type of investment plan is the PA College Savings Plan, also known as the PA 529 Investment Plan. This plan offers Vanguard funds, and a number of different portfolio options. Regarding the cost, Vanguard is typically one of the lowest-cost fund companies on the market, with a solid track record of performance. They offer portfolios of nearly every sort, and (almost) every fund has internal expenses below 0.25%, which is definitely a positive.

They will also offer target-date funds, which time up for a child’s college admission. Much like retirement, timing is important when it comes to investing. Therefore, you want to make sure your account is not overly aggressive just prior to beginning or during the college years. It’s important to make sure you’re reviewing your investment choices regularly.

Other State College Savings Plans

As previously mentioned, PA residents can invest in any state’s college savings plan. There are quite a few good plans in other states, including the my529 plan in Utah. Another solid choice is the Michigan Education Savings Program. Both plans are regarded as two of the best and are the only two to receive Morningstar’s Gold Rating for 529 plans. So while Michigan’s college football team has dominated in the Big Ten, their 529 plan is also the gold standard of late!

That being said, these options are 2 of many, but should be highly considered when it comes to finding the right place to invest. Let’s take a look at the other types of 529 plans, pre-paid plans – specifically the PA Guaranteed Savings plan.

PA529 GSP

The PA 529 Guaranteed Savings Plan is offered through the PA Treasury. The risk is essentially transferred to the state of PA, as they’re responsible for covering any tuition increases that take place. For conservative investors, this is a more commonly chosen path.

The PA 529 GSP does state that you can purchase qualified postsecondary expenses such as room and board, books, supplies, equipment, etc. You will want to get contributions in before August 31st (generally speaking), since the inflation adjustment is typically done every Sept 1st.

PA529 ABLE Account

PA also offers accounts for people living with disabilities. To qualify for federal benefits, families who have a child with a disability must keep $2,000 or less in a savings account, which could drastically hurt the ability to save or invest. As a result, ABLE plans came to market, which can provide a greater ability to save for a goal.

Thankfully, PA offers these plans through the state. These funds give people with disabilities the flexibility needed to save in a tax-favorable way. More information can be gathered on the state site here, which covers benefits and eligibility requirements.

Who can contribute?

The beauty of the 529 plan is that contributions can be made by nearly anyone! The key is that there needs to be a custodian over the age of 18 (typically, but not always, the parent). But anyone is able to contribute to the plan, which can be of great usage for grandparents or relatives who want to help the child.

For parents wanting to contribute, you can contribute quite a bit to the plan. Married couples are allowed to contribute up to the annual gifting limit ($17k per person, $34k per couple) and not have to worry about a gift tax. You can also give a 5 year contribution in one year ($85k per person, $170k per couple) and spread out that contribution over 5 years for gift tax purposes. There are some good resources to reference in this article.

Other Uses

529 plans have added some incredible flexibility in recent years. Thanks to the Tax Cuts and Jobs Act of 2017, up to $10k of K-12 tuition only expenses, in the aggregate per year per beneficiary, may be treated as a qualified distribution. Therefore, if you have a child who is attending a school that requires tuition, it can pay to save in the 529 plan first to get the tax benefits.

Additionally, the SECURE Act of 2019 allowed distributions taken after 12/31/2018 to be used to repay qualifying private and federal student loans for both the beneficiary and the siblings of the beneficiary. There is a $10k lifetime limit for this, however. Thankfully, that limit does apply to each of the siblings separately.

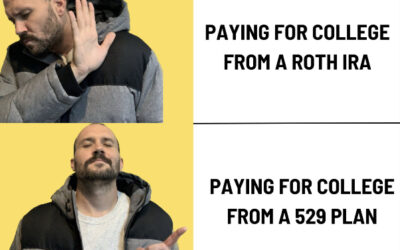

Lastly, the SECURE Act 2.0 also allowed for additional flexibility for unused funds. This article helps explain some of the criteria. From a high level, it allows for unused 529 funds to be rolled into an IRA. This can provide a head start on retirement for graduates not using a 529 plan.

What if I don’t use them?

There can be a few different scenarios in which you don’t use a 529 plan. I think it important to run through some of those in this section.

What happens if my child gets a scholarship?

Normally, a non-qualified 529 plan withdrawal leads to potential taxes & penalties. Any interest earned is treated as income and a 10% federal penalty is tacked on. However, if the withdrawal is a result of a scholarship received, no penalty is applied. The interest earned will still be taxed as income, but that’s as good a scenario you could possibly hope for. In the event the child chooses a US Military Academy, it’s possible this same scenario would play out. That said, the amount of the scholarship or military academy cost of attendance must equal the withdrawal in order to qualify for the potential penalty waiver.

What Happens if the Cost is Less than the Account Balance?

As mentioned previously, there are some options. You can pay off qualified student loans (up to $10k/lifetime) with these funds. Starting in 2024, the Roth “rollover” can become a reality for qualifying 529 plans. But another feature that can be utilized is the transfer of beneficiary. If there are multiple siblings that are planning college, you can transfer the account to the sibling tax & penalty free. This allows for the family to utilize the 529 plans for children with different career paths without incurring penalties. The definition of a family member is fairly broad, and includes in-laws & first cousins in many instances.

What are the other Options?

There are at least 2 other feasible options available. The first is that you can hold the 529 plan. There is no time limit on a 529 plan, so they can be help in perpetuity. Some accounts, like Coverdell funds, require you to liquidate these funds by a certain age. By holding these funds in the 529, you can transfer to another family member down the road, or to someone who may have more use for this.

You can also take a non-qualified withdrawal, although that is typically the last thing I’d recommend if possible. As mentioned previously, you have to pay income tax on the earnings, plus a 10% penalty. In PA, these non-qualified distributions are also considered taxable at the state level.

Taxes

While we’ve covered a good bit of taxes to this point, it’s good to recap and make sure that you understand the tax benefits of the 529 plans. PA has a state income tax rate at 3.07%. Contributions to a 529 plan are state-tax deductible, which provides a nice savings for taxpayers. For every $1000 contribution, it leads to a $30 savings in state tax.

The benefit of PA though, is that you can contribute to any state plan to get that benefit. Many state plans require you to contribute to the resident-state fund to receive a tax break. But PA? Thankfully, it is one of the few states that allows you to invest in any state’s plan. Therefore, if you really like the Michigan or Utah plan (or any plan for that matter), have at it!

The 529 Plan guide for PA residents does cover some of the taxes federally, but also at the state level. That said, it’s always recommended you meet with a certified tax professional when discussing tax and investment related advice.

Which Strategy is best?

What would the 529 Plan guide for PA residents be without some high-level recommendations?

For more conservative investors, it’s understandable why many might want to choose the PA GSP. I do think it’s a viable option, but I think time horizon should dictate the willingness to take risk. For example, for a newborn, if you’re planning to start a 529 plan, you have time on your side! The factors such as K-12 tuition is definitely a factor, but if it’s for college, you shouldn’t be afraid to take on some level of investment risk. Much like I’d never recommend bonds & cash for a young employee investing in a qualified retirement plan, I’d think the same for a child 18 years away from college.

The PA GSP should definitely be considered for contributions as the child gets closer to college. The closer you are to using the funds, the less risk you should be willing to take. Why? Consider recent history! 2022 was a rough year for investors. If your child was a senior then, and your 529 is overleveraged in stocks, you’d have lost a significant amount. By keeping the account conservative as college is approached, that’s a sure fire way to make sure you can properly budget and plan accordingly.

Target date funds can also be used. The advantages with these accounts is that they will essentially do what I just outlined automatically. For someone who considers themselves more “hands-off,” this is very viable option. For someone who frequently changes investments, you must be aware that 529 plans can be allocated twice a year. But I do not recommend you try to time the market, as the strategy can drastically backfire if you’re wrong.

Conclusion

Needless to say, these plans require some attention and planning. If you’re going to go at it alone, I recommend the following:

- Define your risk tolerance & time horizon

- Budget your college/education accordingly

- Strive for low-cost funds, and utilize a state’s plan that has a good track record

- Make sure you budget your financial plan accordingly, as you don’t want to save too much in 529 plan if it takes away from other goals

For those using an advisor, I hope you get value from the 529 plan guide for PA residents and take it to him/her. Regardless, these plans can and should be considered in some form or fashion if your child is considering college.