Each year there is a good chance that the IRS will set a new contribution limit for investment accounts, or that the rules will change. 529 plans are no exception. Here’s what you need to know about 529 plans in 2023:

Increased Contribution Limits

Parents and/or close family members have seen the 2023 529 plan contribution limits increase. This means a married couple can contribute up to $34,000 ($17k from each parent) to one child with no federal gift tax implications whatsoever. Should parents want to go beyond that, it’s possible to do so. The only thing to consider is that it could run you into the $12.92 million lifetime gift tax exclusion. In other words, if you’re looking to contribute in excess of the $17,000/year, so long as you don’t contribute past the $12.92M in your lifetime, you will not owe a gift tax. Each state sets its own limits contribution limits. Check out your state’s rules.

Super Fund

You can also “super-fund” a 529 plan, over a 5-year period. If you choose to do the 5-year election, the IRS will treat a one-time contribution as if it were spread over 5 years. This can allow for a sizable inheritance, bonus, etc. to be applied to a child’s 529 plan without worrying about gift tax reporting. Note: you will need to report a Form 709. You cannot contribute in excess of this amount over the next five years from the initial contribution. If you’re going to do this, you want to make sure it’s possible to do for state tax purposes as well, by reading each applicable state tax law.

It’s important to note that 529 plans are administered by each state, and certain states only allow for their residents to contribute to their state’s plan in order to receive a state tax deduction (New Jersey for example). Some states (like Pennsylvania), allow you to receive a state tax deduction regardless of which state’s 529 plan you contribute to.

In addition to a state tax deduction, savers should be looking to avoid paying commissions to a broker. Each contribution could be charged a sales charge if set up through a broker. Advisors will likely charge fees, but they should be transparent and should be focusing on low-cost funds.

Parents should also know the time horizon of the child, and base their investment choice accordingly. Vast market swings can cause a decrease in the balance of a 529 plan. Keep this in mind for kids who are only a few years away from college.

What to Consider for a 529

Parents should consider a number of factors before saving into a 529 plan. If the parent/child does not use the funds for a qualified educational expense, the earnings amount will be subject to a 10% penalty. Also, the earnings will be considered taxable income. California even imposes an additional 2.5% state income tax penalty on earnings that aren’t used for qualified educational expenses.

Parents should first analyze their goals and current financial position. Saving for a child’s future education can be very rewarding and also help tame the very high cost of college. Remember to fund other important items first. These include an emergency fund and retirement plan. Also, pay off high-interest debt (notably, credit cards) before going all-in on college savings.

The Benefits of a 529 Plan

The main benefits of the 529 savings plan are that the funds grow tax-deferred, and they can be used tax-free if used for qualified educational expenses. The contribution limits are typically much higher than other college savings plans, such as a Coverdell account, and the tax deferral is an advantage over a custodial account, which is taxed at the child’s tax rate.

529 savings plans typically earn higher interest than most savings accounts. Although, interest is not guaranteed. The earlier you start, the greater the compound interest will take effect.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Albert Einstein

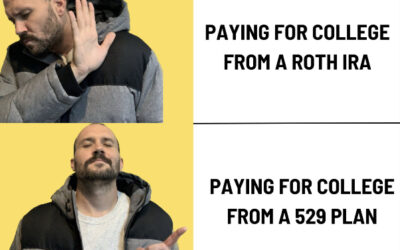

Roth IRA’s are also a popular tool to save for college. They can shelter as assets and do not need to be reported when you apply for financial aid. Note: If you’re under 59 1/2 and want to withdraw earnings, you will be subject to a 10% federal tax penalty.

529 plans also allow you to use up to $10,000/year for any K-12 qualified tuition expenses. Achild may use (lifetime) up to $10,000 from a 529 plan to pay off student loans.

529 plans are transferrable. You may transfer the balance of the account to another family member or child, if one child does not use the full account balance.

And that’s what you need to know about 529 plans in 2023! Have questions? Reach out to me.