You may have heard of qualified education expenses. They’re types of expenses the IRS allows for special tax treatment. It’s similar to qualified withdrawals from a retirement account. If a withdrawal is “qualified,” you won’t have to pay a penalty, or in some cases, any tax at all. But, you must follow the rules. To make matters more confusing, “qualified education expenses” vary from account & loan type. The IRS does give us a breakdown of these expenses in their most recent publication 970. But it’s 79 pages long! Thankfully, TheCollegeDude is here to help. I read the publication so you don’t have to. More importantly, I broke down the sources to pay for college in an easy to see graphic. The purpose of this post is to break down qualified education expenses and allow you to stay compliant.

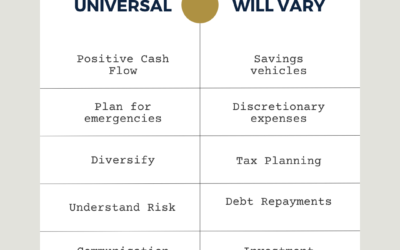

Scholarships & Grants

You may not know this, but some scholarships & grants are taxable. In the event you receive scholarships & grants in excess of required books, equipment, and tuition and fees, the “gift” is taxable. The chart below shows each of common expenses and if the IRS considers them to be qualified.

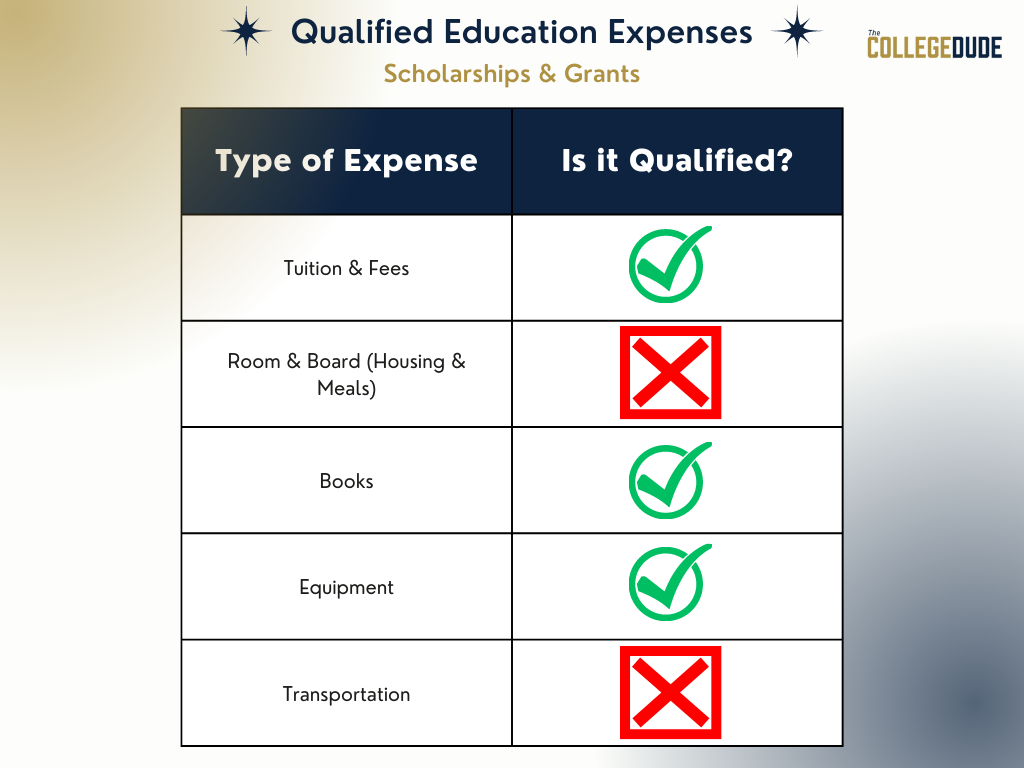

American Opportunity & Lifetime Learning Tax Credit

I’m a big fan of tax credits. Specifically education tax credits. These can be utilized to help offset taxable liability for parents sending children to college. They can also be utilized by adults returning to school. But you must understand that not every expenses qualifies. To make sure you’re doing this correctly, check the chart below and understand which expenses qualify.

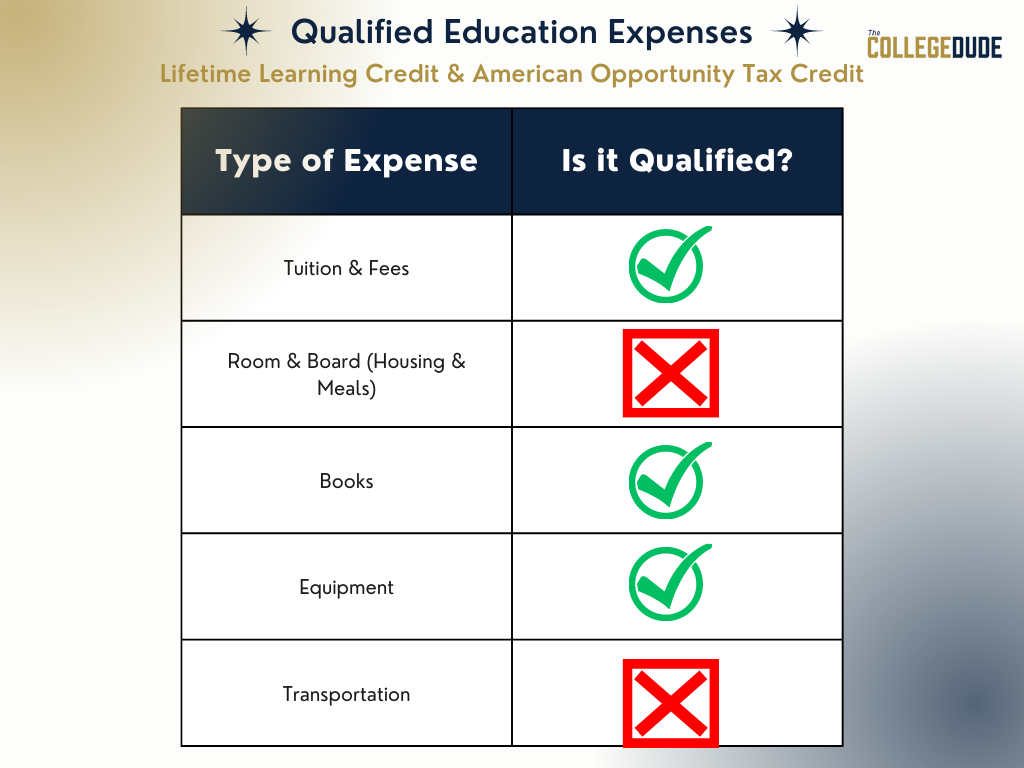

Student Loan Interest Deduction

When it comes to qualified education expenses, no definition is more generous than the student loan interest deduction’s definition. These cover all the necessary expenses you can imagine. You must use a qualified student loan, which is another factor. But generally speaking, the student loan interest deduction allows for the maximum usage of qualified expenses.

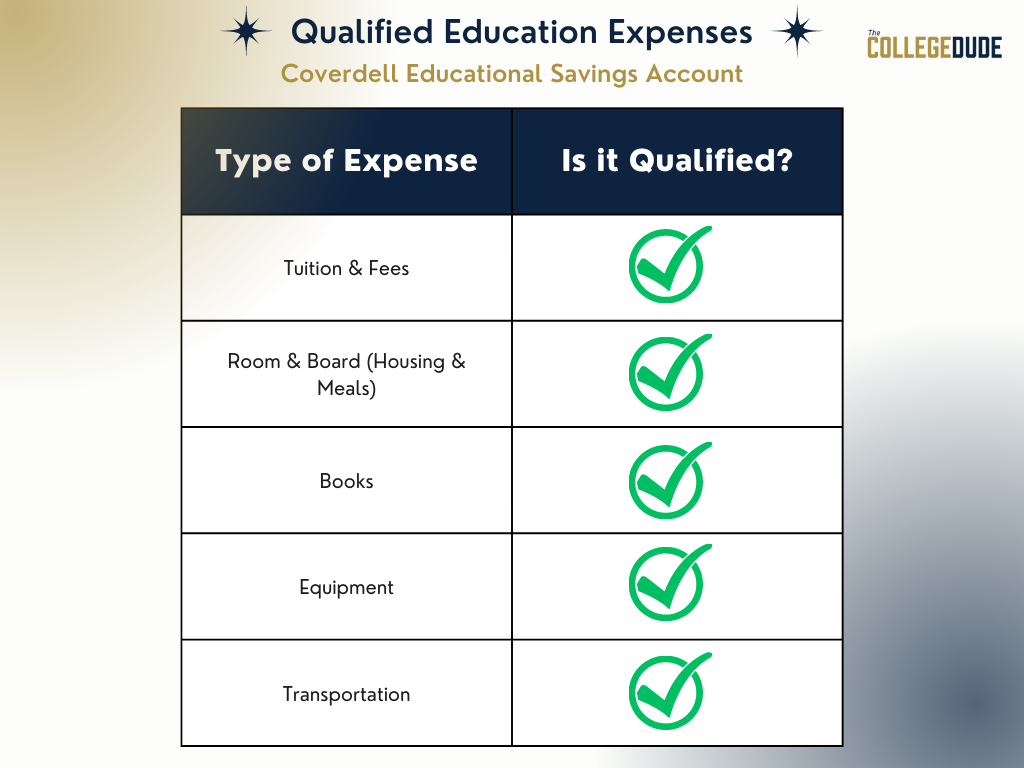

Coverdell ESA

While the Coverdell ESA has been replaced in practice by the 529 plan, it still exists for a number of accountholders. While it isn’t as flexible as the 529 plan, it does offer some benefits. One major benefit allowed by the Coverdell is the flexibility of what is a qualified payment.

NOTE: Transportation is considered a qualified expense, but only for eligible elementary & secondary schools.

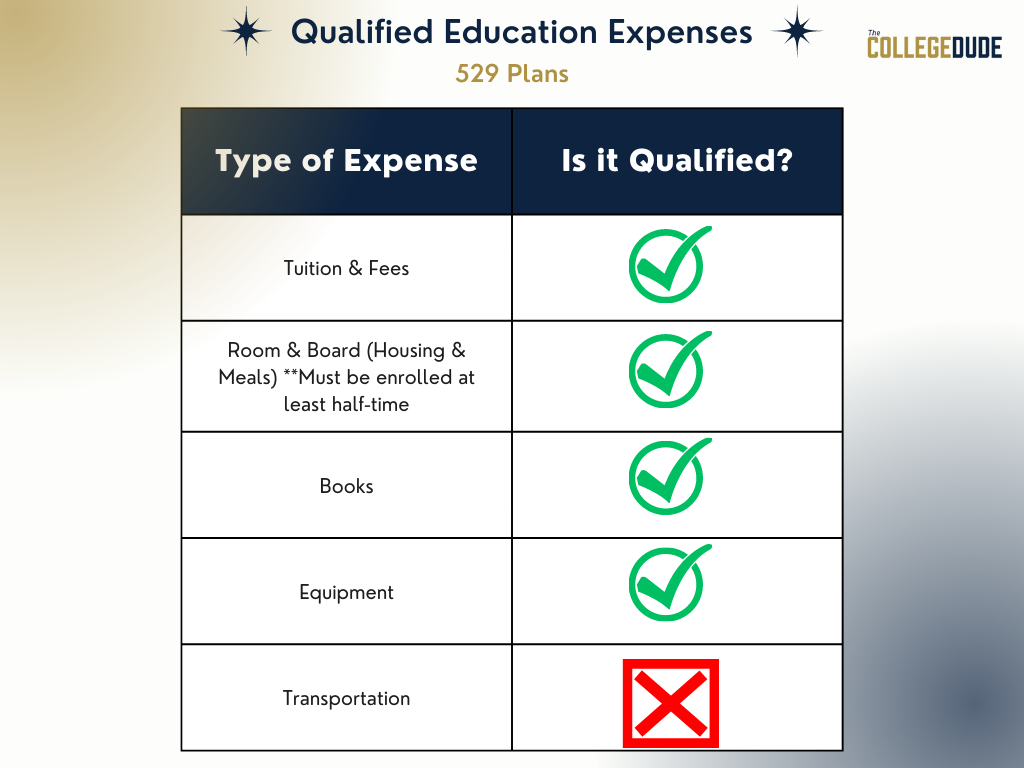

529 Plans

529 plans are also referred to as Qualified Tuition Plans. These plans offer major flexibility and are great ways to save for college. In recent years, the IRS has expanded the definition of qualified expenses. These include tax free beneficiary transfers, student loan payoffs (up to $10k lifetime), and even a rule allowing transfers/rollovers to Roth IRAs. I do believe they are best used for college expenses, however, and the chart below confirms that.

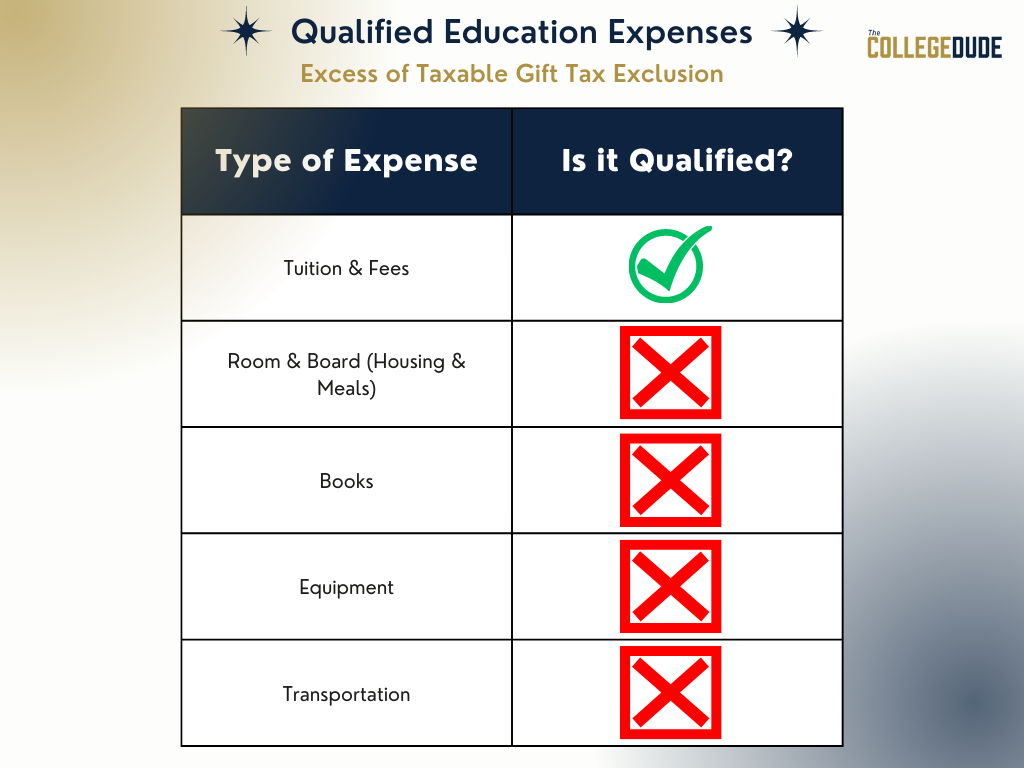

Non-Parent Gifts for College

The IRS does allow non-parents to make tax-free gifts for college. While it is only tuition it allows, this can be a great way for grandparents to help pay for college. It’s become more and more popular to see grandparents save in 529 plans, but this plan can allow grandparents to also pay for schooling in a tax-efficient manner.

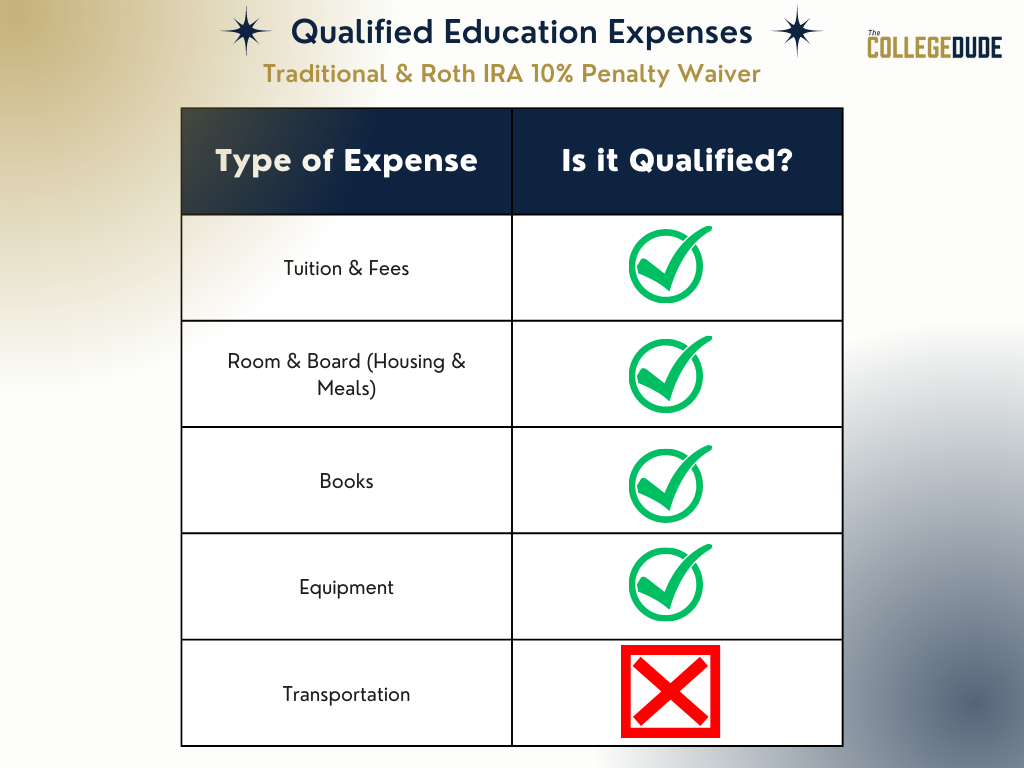

Early IRA Withdrawals

IRA stands for Individual Retirement Account. So why are we talking about IRA’s and college funding? Well the IRS allows for a waiver of the 10% penalty if the funds are used for college expenses. That does not mean that you should do this, and the growth is taxable as income. But the waiving of the 10% penalty can help offset an otherwise taxable penalty. It is also a popular way for children to pay for college if they have an IRA.

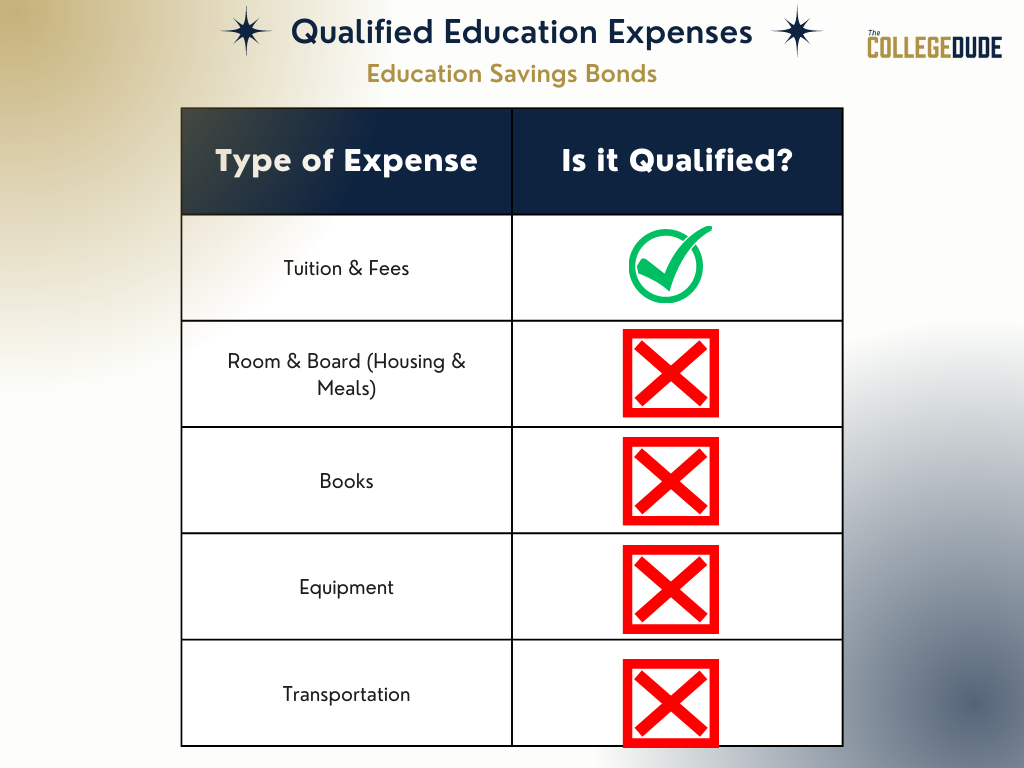

Education Savings Bonds

While Education Savings Bonds are no longer a popular way to save due to income requirements and better ways to save for college, they do still exist. Below, you’ll see they’re not overly flexible when it comes to paying for college.

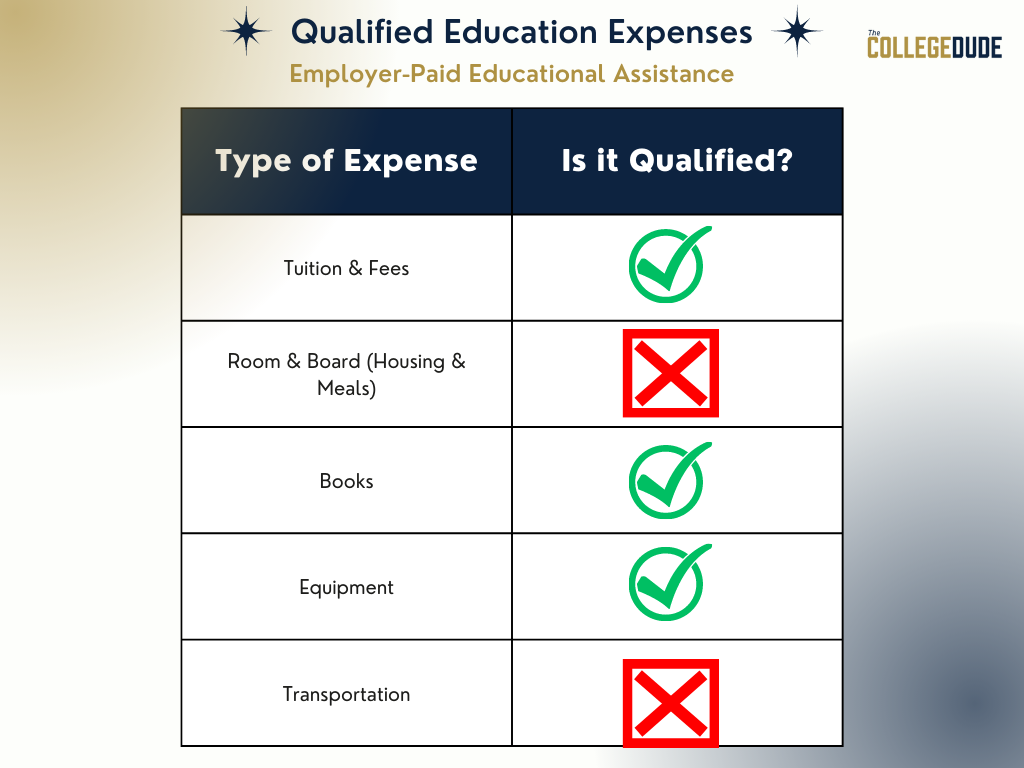

Employer-Provided Educational Assistance

A great way to pay for college is to have your employer help front the bill. It can be great for both the employer and employee when it comes to saving on taxes. It also can help strengthen the retention between employer & employee, which is needed in today’s day and age. Here are the expenses available.

Conclusion

The IRS thankfully gives us an idea of what qualified education expenses are, but they can be confusing across so many different ways to save and pay for college. Knowing how to properly include educational expenses is critical to avoiding penalties in event of an audit. Staying up to date while saving on taxes is critical to help paying for college.